Table of Contents

Gold, one of the most sought-after metals for thousands of years, remains a popular hedge investment. The stability, intrinsic value, and universal appeal of gold make it especially attractive to investors during economic ups and downs. If you’re considering purchasing physical gold, one of your first questions is probably, “How much is an ounce of gold worth right now?” or “How much is gold per gram?”

To explain the gold price better, let’s clarify what “ounce” actually means in the context of gold and other precious metals, and which factors determine the price of gold today.

How Much Is a Gold Troy Ounce Worth?

The gold spot price hovers around $1,965 per troy ounce. However, the price of gold changes constantly, so make sure to check an up-to-date price list before purchasing physical gold.

What Is a Troy Ounce?

A troy ounce is a weight unit that is slightly different from a standard ounce. Troy ounces apply to gold, silver, other precious metals, and gemstones. The term “troy ounce” originated in Troyes, a French town that used to be a major trade center in the 16th century. Historically, a troy ounce was the weight equivalent of 480 barley grains.

How Does the Troy Ounce Differ From a Standard Ounce?

A standard ounce equals approximately 28.35 grams. A troy ounce is about 10% heavier, equaling about 1.097 regular ounces.

How Much Does a Troy Ounce of Gold Weigh?

A troy ounce of gold weighs 31.1 grams. A troy pound equals 12 troy ounces, or 0.823 standard pounds (a standard pound contains 16 regular ounces).

Does the Purity of Gold Affect Its Price per Ounce?

When you ask, “How much is an ounce of gold?” A more accurate question for gold investors would be, “How much is an ounce of 24-karat gold?”

Pure gold is highly malleable and prone to scratching. For this reason, manufacturers of gold jewelry and gold coins typically use gold alloys, usually 14 karat or 18 karat (the other metals in the alloy are often silver and copper). These gold alloys contain gold and some other metals to improve the item’s durability.

The price of gold per ounce is directly proportionate to its purity, so if you ask, “How much is an ounce of 14-karat gold?” the answer will be “much lower than 24-karat gold.”

A brief recap of gold purity measurements: You can define the purity of gold either by karats or by millesimal fineness. The historical karat system measures purity by fractions of 24, so 18k gold contains 18 parts gold and 6 parts other metals. Millesimal fineness indicates gold purity in parts per thousand, so following the millesimal system, 14k gold would be stamped 0.585 (i.e., containing 58.5% gold).

If you’re interested in purchasing physical gold, pure gold (stamped 999.9) offers the highest value and is the easiest to resell for a predictable price.

What Factors Influence the Price of Gold?

Gold is very good at retaining value throughout economic fluctuations. Markets may boom and collapse, but gold has remained a precious, internationally recognized commodity for thousands of years. Nevertheless, gold prices change based on various factors, and knowing these can help you make the most of your investment.

Supply and Demand

As with any other commodity, gold prices depend on supply and demand. While physical gold doesn’t disappear like oil and other consumables, gold may become scarce, either because of higher demand (for jewelry or physical gold as an investment metal) or any limitations in gold mining. According to cautious estimates, only about 20% of the total gold in the earth is left to be mined.

If central banks buy more gold as reserves, this means less gold in the market and thus higher prices. Similarly, when individual investors and EFTs (exchange-traded funds) purchase more gold, the price of gold will rise because of increasing demand.

Economic Conditions

Historically, the price of gold has tended to rise whenever a recession hits. When stocks plummet and the future looks uncertain, people tend to buy gold as a commodity with enduring value. For instance, demand for gold as an investment metal skyrocketed in 2007 following the stock market collapse.

It’s easy to see the appeal of gold in an unstable economy. Compared to other assets, gold is less vulnerable to market fluctuations. Moreover, you can usually count on reselling your gold bullion or legal tender coins easily enough and at a fairly stable price.

The policy of central banks during market crises also contributes to gold price trends. When the economy is stable, central banks tend to favor more profitable assets over gold and sell their gold bullion at a lower price. In contrast, when stocks crash, banks hold on to their gold and drive prices up.

Currency Fluctuations

Generally, the stronger the U.S. dollar and other major currencies are, the lower gold prices will be, and vice versa: when currencies fall, the price of gold climbs.

National currencies used to be tied directly to gold prices in what was called the gold standard, but today most countries have fiat currencies with different factors influencing their value. Decreased trust in a national economy or in the government’s ability to repay loans leads to a dip in a fiat currency’s worth. When this happens, more people choose gold as a safe haven investment, and gold prices rise.

Interest Rates

Interest rates and gold prices often have an inverse relationship. Compared to other assets, like stocks and bonds, gold generates little to no dividends or increased value. Thus, when interest rates are high, investors tend to prefer higher-return assets. However, when interest rates fall, gold becomes a more attractive investment option thanks to its stability, which makes gold prices go up.

How Can You Determine the Weight of an Ounce of Gold in Different Forms?

If you want to invest in physical gold, you may consider gold bars, bullion coins, or even gold jewelry. Whenever you discuss ounces of gold, remember that the term refers to a troy ounce (31.1 grams).

Bullion

Pure gold bars are available in a range of sizes, with 1 troy oz and 10 troy oz being some of the most popular. You’ll usually see the bar’s weight stamped on the surface in both grams and troy ounces.

Coins

Popular bullion coins like the American Gold Eagle and the Canadian Maple Leaf typically contain 1 troy oz of pure gold. Note that American Eagles have a slightly higher gross weight because they’re only 91.67% gold.

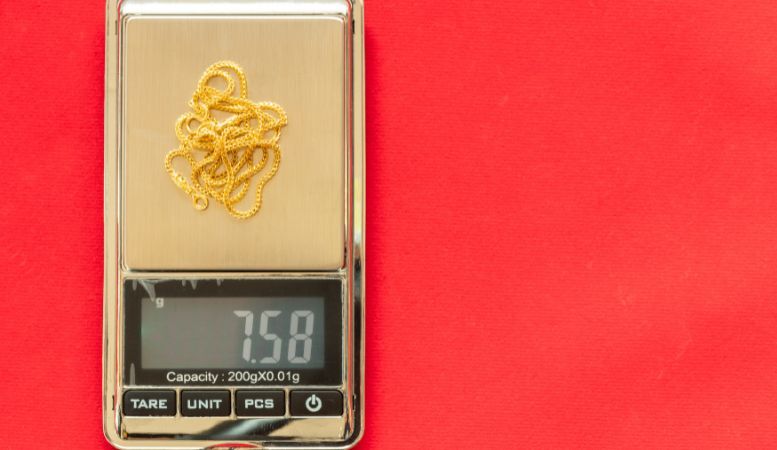

Jewelry

Gold jewelry typically consists of alloys and 14k or 18k gold. To find out the amount of pure gold in a jewelry piece, multiply the item’s weight in grams by the percentage of gold (e.g., 0.585 in 14k gold).

Whatever type of physical gold product you choose, it’s important to purchase from a reputable dealer to avoid scams or counterfeit gold.

Purchase High-Quality Gold From Oxford Gold Group

Are you looking to include physical gold in your investment portfolio? Browse high-purity gold products by Oxford Gold Group, including gold bars and bullion coins. Also, make sure to claim your free copy of our Precious Metals Investment Guide to learn more about precious metals and their price trends beyond “How much is an ounce of gold?”.