If you’re looking to diversify your investment portfolio with tangible assets, you’ll find the highest quality silver products right here at the Oxford Gold Group. From rare and popular silver coins to pure, practical silver bars, we aim to offer the industry’s best prices and service.

World-famous and reliable, a great choice for beginners and experts alike.

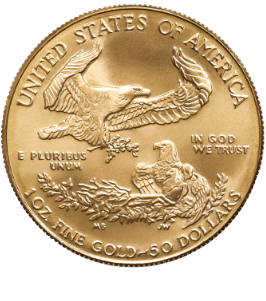

Consistently high value and undeniably beautiful, it’s a staple for a reason.

Unknown to most, this expensive metal is perfect for any investor's portfolio.

The precious metals market may seem intimidating, but it’s not as it seems. Our team has compiled a summary of our tips and information into a free guide so you can learn how to begin securing your future.

We treat our customers as individuals and will work with you to help you meet your financial goals. Explore our inventory of silver coins and bars below, and feel free to contact our precious metal investment specialists if you have any questions or don’t see what you’re looking for. We’re always happy to help.

When it comes to precious metals, gold may be the more popular element for investors due to its high trading value, but silver is becoming more attractive even for expert investors due to its diversity and affordability.

Silver prices are volatile on the trading market but much lower than gold. This combination can offer more bang for your buck as you can purchase higher quantities for lower amounts and earn more leverage on the trading markets.

Plus, silver coins and bars still hold value during economic downfalls, such as the current state of affairs, when paper currencies, stocks, and bonds depreciate.

The price of silver continues to rise as demand surges. In 1979, silver costs increased from $6 to $49 per ounce, boasting a 700% increase within a year. However, the United States debt level was at $930 million at the time.

As the economy destabilizes due to the pandemic and the debt ceiling tops $4 trillion, silver could be the saving grace for many investors or those with Individual Retirement Accounts, better known as IRAs.

Silver is known for being the best at conducting electricity and heat, as well as a great reflector of light. The common, white mineral is vital in a variety of industrial, consumer, health, electrical, and energy-related sectors, including:

Silver mining may be reaching its peak as demand rises. Production costs have increased, and the supply is diminishing quicker than ever before. Only approximately 18 billion ounces of extractable silver are still available around the world. This supply and demand will drive up the value of silver over time.

Investing in silver coins and bars is becoming the norm for those who want to secure their wealth. Depending on how it’s used, silver is considered both a currency and a commodity. Investors can resell their silver investments to practically any industry for an abundance of uses.

Due to its volatile pricing, silver is also more easily accessible to everyone, from beginners to seasoned investors. Investors often purchase silver by weight — such as kilos, grams, pounds, or troy ounces — in 99.9% fine silver bullions, bars, coins, and rounds. The lower the levels of purity, the lower the price.

Silver has value around the world, despite economic conditions. Buying silver bars at current market prices can provide a big return for those who resell it to vital industries around the world.

Owning precious metals such as silver can reduce the overall risk of other investments, such as stocks and paper currency. Stocks fluctuate every second of every day and are highly dependable on consumer and business trends. A solid investment in one stock could cost someone their life savings, while physically owning silver and gold sets that worry aside.

The value of paper money has been on the decline for many decades and could worsen as the government prints more bills during the economic downfall caused by the coronavirus (COVID-19). Precious metals have always held value and will help guard your portfolio against inflation, as they preserve purchasing power. Silver has never been, nor will it ever be valued at $0.

It is a limited resource—thus, it has the potential to gain value as demand increases. Unlike paper money, silver cannot be duplicated or recreated on a computer. As a result, silver stands to gain you a higher return on your investment.

At Oxford Gold Group, we specialize in turning silver into IRAs so individuals can look forward to their retirement without worry. The precious metals IRA depository storage provides the ultimate security with private, non-government, and non-bank storage locations throughout the United States.

None of the precious metals purchased will be a digital contribution or otherwise. All silver deposited into an IRA will be securely shipped and physically deposited into one’s account.

Keep in mind that all IRA distributions are taxable by the IRS. However, those who invest in precious metals know that their dollar value won’t depreciate throughout the years, as risky stock market investments can.

When selling silver coins or bars, it’s essential to know their value before negotiating a sale. Investors often check the COMEX to access indices for prices and NASDAQ in the morning and evening to see silver’s current value.

The spot price should always be verified before buying, selling, or trading silver. Feel free to reach out to our team before making any decisions. We offer competitive pricing and are dedicated to customer service.

Silver coins are one of the oldest currency types in history, dating back to Greek times. Most coins are minted by governments for financial value, but collectors may purchase coins as a hobby.

The silver coins you’ll find here at the Oxford Gold Group weigh between 31 grams and 1.5 ounces and are made of 99% (.999) fine silver. Our coins have been issued as legal tender in the United States, Canada, and Australia, among others, and are highly collectible. All of our silver coins are also suitable for IRA investing, so your funds never depreciate.

While we work to update our silver coin inventory continually, you’ll often find:

The coin is guaranteed to contain one troy ounce of 99.9% pure silver and has had an uncirculated version pressed for coin collectors. The Silver Eagle has been produced at three mints: the Philadelphia Mint, the San Francisco Mint, and the West Point Mint.

This 1.25-ounce coin is the official tender of Saint Helena and minted with 99.9% pure silver. It was released in 2018 with a domination of £1.25 and is recognized and accepted throughout the world for its purity and symbolizes Britain’s rising colonial power.

Silver rounds, also known as medallions, are not as well-known as silver bars but can be purchased with no face value or legal tender. This point allows investors to keep up with the demand of silver by creating unlimited mints.

Silver rounds are usually 1 ounce or smaller in weight and available in smaller quantities. They are similar in size and shape to coins but are made by private mints instead of government entities. Silver rounds are often used to commemorate events or public figures with unique designs and mint marks. All reputable silver rounds have a certain purity and silver mass.

Silver bars, also known as bullions, are offered in a variety of finishes, appearances, and weights. Most weigh between 5-10 ounces or more and are often ordered in bulk quantities to produce silver coins and rounds in mass quantities. The two primary forms of silver bars are cast/hand-poured bars and minted ingots.

Cast/hand-poured bars have the classic iconic appearance of silver bars. Hand cast bars are created by pouring silver into a cast mold and letting it cool. Some mints allow the bars to cool via air while others cool their bars in tubs of water.

Minted ingots start as cast bars that are run through state-of-the-art presses that stamp and cut the bars into specific sizes. They are more highly refined than their hand-cast counterparts and are more elegantly visual as they’re cut to precision.

Some of the silver bars you’ll often find here at Oxford Gold Group include:

Investors trade larger bars up to 500 ounces on COMEX and other major exchanges. These bars are also sold in gram or fractional ounce sizes and can appear as 1,000 oz bars. The smaller bars cost more per ounce as they’re higher to produce per each ounce of metal.

Two types of refineries/mints produce silver bars, coins, and rounds worldwide: sovereign mints and private mints.

Sovereign mints are produced by government entities as currency, ranging from one cent to many dollars. They often weigh a few ounces and feature people, places, or things of historical or significant value. They also typically feature a motto and the amount of currency they represent.

Private mints produce commemorative or collectible pieces that have no face value. Sports figures, entertainment headliners, logos, business names, and other non-monetary representations are often found on this type of silver.

Sovereign mints include:

Private mints include:

Precious metals such as silver are becoming more popular as paper currency depreciates. Replacing stocks and paper currency with silver can save a lifetime of worry, as precious metals will never lose that much value.

Buy silver coins and bars right here at the Oxford Gold Group and balance your investments today!

By clicking the button above, you agree to our Privacy Policy and Terms of Service and authorize Oxford Gold or someone acting on its behalf to contact you by text message, ringless voicemail, or on a recorded line at any telephone or mobile number you provide using automated telephone technology, including auto-dialers, for marketing purposes. No purchase required. Message and data rates may apply. You also agree to receive e-mail marketing from Oxford Gold, our affiliated companies, and third-party advertisers. To opt-out at any time click here or reply STOP to opt-out of text messages.

"*" indicates required fields

"*" indicates required fields

Inside this Free Investment Guide