If you’re looking to diversify your investment portfolio with tangible assets, you’ll find the highest quality platinum products right here at the Oxford Gold Group. From rare and popular platinum coins to pure, practical platinum bars, we aim to offer the industry’s best prices and service.

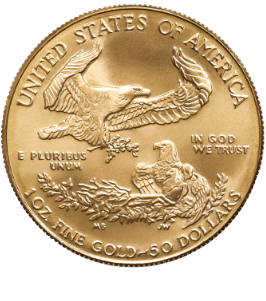

World-famous and reliable, a great choice for beginners and experts alike.

Relatively low-cost and widely produced, silver can be useful to anyone.

Unknown to most, this expensive metal is perfect for any investor's portfolio.

The precious metals market may seem intimidating, but it’s not as it seems. Our team has compiled a summary of our tips and information into a free guide so you can learn how to begin securing your future.

While not nearly as widely-known in the investing world as gold and silver, platinum is the third most-traded precious metal in the world—and it can be a sound investment due to its industry-driven demand and relative rarity. Both factors have led it to price above gold frequently in recent decades.

If you’re ready to give platinum investment a try, you’ll find the best prices and highest quality platinum coins and bars right here at the Oxford Gold Group. Browse our inventory and feel free to contact us if you have any questions or aren’t finding the platinum product you’re interested in. We put customer service above all else and are always happy to help.

First discovered in South America, platinum is among the rarest precious metals in the world, 20-30 times rarer than gold. The word platinum derives from the Spanish word “Platina,” which means “little silver,” a fitting description given its white to silver grey appearance that can be hard to differentiate from silver.

As South Africa holds about 80% of the world’s reserves, most platinum comes from that region. A point that leaves it far more vulnerable to supply disruption and adds to its scarcity. While used in coins, bars, and jewelry, platinum is more commonly used for industrial purposes, particularly automotive parts and medical devices.

About 8% of the current platinum demand is from investors, 31% from the jewelry industry, 33% from the automotive industry, and 28% from other industrial purposes.

Unlike many precious metals that find their demand more entangled with investor interest, platinum is far more dependent on numerous industries.

It is heavily utilized in the automotive realm to make catalytic converters. As the push for green cars continues, manufacturers are looking to reduce their emissions. That means new and improved catalytic converters—in fact, 95% of combustion engines on the road now feature a catalytic converter.

Platinum is also very commonly found in another growing industry: healthcare, where it is used to make electronic sensors, catheters, stents, and more. Its necessity in several growing industries near guarantees platinum’s continued demand over time, which means it’s likely to hold its value well.

Your next question is probably: is platinum a better investment than gold? The answer is that it can be. Gold is stabler than platinum price-wise and better known in the investment world, but as mentioned, platinum is tied closely to a range of growing industries and is likely to increase in value in the future. If you ask us? Invest in both! Our inventory includes an impressive selection of gold coins and bars as well.

You have three options when investing in platinum: stocks, ETFs, and physical bars and coins.

Platinum stocks aren’t particularly common as most are tied to mines or production operations, and as mentioned, there aren’t many, and those that do exist are mostly in South Africa.

Platinum ETFs are a slightly safer option than stocks as they are usually tied to physical platinum. A fund holds a store of physical platinum, and you buy a share of that store, which is then bought and sold on your behalf.

Given this, it might come as no surprise that bars and coins are the most common form of platinum investment.

Platinum has only served as regular currency once, in Russia between 1828 and 1845, as it’s rarity and resemblance to far-more-affordable metals, like silver, make it impractical. Its rarity has also led to a more limited range of options for collectors and investors. Still, the few platinum coins that are available make a stunning addition to any portfolio.

Here’s a bit about the most popular platinum coins on the market today. At the Oxford Gold Group, we often have all the above in our inventory—and if we don’t, we’re happy to help you find them.

The Perth Mint has put out a range of animal-themed platinum coins over the years, including dolphins, platypus, and kangaroos, among others. These platinum coins often contain between .333 ounces and one ounce of 99.95% platinum.

Most show the featured animal on one side, while the other side pays homage to the Commonwealth with a bust of Queen Elizabeth II. The rarity of these coins varies based on design, but all are released in limited quantities yearly, often in bulk packs of 20-100 coins.

These coins also feature a range of designs at various weights, but all are 99.95% platinum.

Platinum American Eagle coins all have the Statue of Liberty along with the mint year and the word “Liberty” on one side, but the artwork on the other side changes every year, showcasing an eagle flying over different scenic areas around the United States.

The United States Mint first released them in 1997, and production levels are currently capped at 10,000 per year. They remain a popular option among collectors as the plethora of designs offers the ability to, well, collect, and eventually obtain the entire set.

Based on the gold Austrian Philharmonic coin—the most popular coin in Europe—the platinum version was released by the Austrian Mint in 2016. It contains 99.95% platinum and features the same design as the gold coin with a face value of €100.

The Great Pipe Organ from the Golden Concert Hall in Vienna is on one side, while the flipside features the collection of instruments played by members of the Vienna Philharmonic Orchestra, including a cello, harp, horn, bassoon, and four violins.

The platinum Maple Leaf coin contains one ounce of .9995 fine platinum. Its front face shows the right-facing profile of Queen Elizabeth II, along with the year and its face value, and the reverse side displays a large, single maple leaf along with the coin’s weight and purity.

The Royal Canadian Mint first minted the coin in 1988, and it was available at a range of weights. However, from 2009 onward, production was limited to the one-ounce version. The impressive longevity of Maple Leaf coins provides the opportunity to collect a massive range of production years. These coins also qualify for precious metals IRAs.

Platinum bars are available from various providers in weights ranging from one gram to ten ounces, with a few heavier outliers. The two best-known options are PAMP Suisse and Credit Suisse platinum bars. These providers also ship bars complete with an assay certificate (a certification of their purity, weight, and production mint).

Platinum bars are eligible for precious metals IRAs, making them even more versatile if you are creating a retirement portfolio.

PAMP (Produits Artistiques Metaux Precieux) Suisse, founded in 1977, is a world leader in precious metal refinery and fabrication famed for their high-quality materials and state-of-the-art technology. They are one of few—five to be exact—Approved Good Delivery Referees recommended by the London Bullion Market Association (LBMA).

Their platinum bars are available in a few weight and design options, including the well-loved Fortuna bars, featuring the Greek goddess of fortune. Their lunar calendar series is also quite popular, boosting all twelve animals in precise detail.

Another well-respected mint, Credit Suisse, is also a financial institution founded under the name Swiss Credit Institution in Switzerland. They have strict metal purity guidelines and mint products exclusively in ingot-form.

Unlike PAMP, they don’t offer much design variety, with almost all their products simply featuring the Credit Suisse logo, bar weight, and purity. However, what they lack in style they make up in quality, making these bars an international favorite for investors.

Platinum coins, and bars to a lesser extent, are available from both sovereign mints and private mints. Sovereign mints include government entities responsible for producing currency, while private mints strictly release coins and bars with no face value that aren’t legal tender.

The largest sovereign mint in the world is the United States Mint. However, it doesn’t hold the title of the oldest mint. That right goes to the Monnaie de Paris in France. Other large mints include the Perth Mint, Royal Canadian Mint, The Royal Australian Mint, and the Austrian Mint.

Popular private platinum mints include Engelhard, Johnson Matthey, Valcambi Suisse, PAMP Suisse, and Credit Suisse, among others.

Investment wise, there are pros and cons to both sides, and whether bars or coins are a better option comes down to a matter of preference.

Platinum coins are available in a wider range of designs, making them more popular among collectors. They are also legal tender, though their face value is often well below their actual value or what you’re likely to pay to obtain them.

Bars are easier to store and lend well to the investment side of things. If you’re not worried about aesthetics—though some platinum bars do come in stunning designs—bars are often the better bet. As their value often doesn’t factor in the rarity of specific mint dates or designs, they also can be more affordable in some cases.

As paper money depreciates and the stock market sways in the economic havoc of COVID-19, tangible assets make for one of the safest investment options available—and platinum is an excellent option thanks to its steady demand, regardless of the economy.

If you’re looking to add platinum coins or bars to your portfolio, you won’t find better prices or service anywhere else. At the Oxford Gold Group, we value our customers and treat them like individuals. We’re here for you and want to see you reach your financial goals. If you need help investing in platinum, give us a call today.

By clicking the button above, you agree to our Privacy Policy and Terms of Service and authorize Oxford Gold or someone acting on its behalf to contact you by text message, ringless voicemail, or on a recorded line at any telephone or mobile number you provide using automated telephone technology, including auto-dialers, for marketing purposes. No purchase required. Message and data rates may apply. You also agree to receive e-mail marketing from Oxford Gold, our affiliated companies, and third-party advertisers. To opt-out at any time click here or reply STOP to opt-out of text messages.

"*" indicates required fields

"*" indicates required fields

Inside this Free Investment Guide