If you’re looking to diversify your investment portfolio with tangible assets, you’ll find the highest quality palladium products right here at the Oxford Gold Group. From rare and popular palladium coins to pure, practical palladium bars, we aim to offer the industry’s best prices and service.

World-famous and reliable, a great choice for beginners and experts alike.

Relatively low-cost and widely produced, silver can be useful to anyone.

Consistently high value and undeniably beautiful, it’s a staple for a reason.

The precious metals market may seem intimidating, but it’s not as it seems. Our team has compiled a summary of our tips and information into a free guide so you can learn how to begin securing your future.

When it comes to investing in tangible assets, your first thought is likely gold or silver, but there are plenty of other worthy precious metals on the market to choose from—like palladium. Similar to platinum in use but far rarer, palladium is an excellent option to diversify your portfolio.

If you’re looking to invest in this industrious metal, you’re in the right place. Here at the Oxford Gold Group, we not only have the best selection of palladium coins and bars but offer them at the best prices with unbeatable service.

You might not remember palladium from science class, but it sits on the periodic table with an atomic number of 46 and is part of the platinum group of metals, including platinum, along with rhodium, iridium, osmium, and ruthenium.

Compared to some precious metals, it was discovered fairly recently—1802—and is among the world’s rarest metals. If all the palladium mined to date was gather in one place, it would fit in a 10 x 10 room.

Luckily, a little goes a long way, and palladium has a wide range of uses. While most often used in emission-controlling catalytic converters in combustion engines, it is also used in dentistry, tools, electronics, water treatment, and jewelry. Some companies even use palladium to manufacture flutes (yes, the instrument) and brass instruments such as trumpets.

When mixed with pure gold, palladium can also produce white gold, a very popular option in the jewelry market. Palladium itself is sometimes used in jewelry, but less commonly, as it is challenging to work with, and its limited supply makes sourcing materials a challenge.

Most palladium is produced in Russia and South Africa (roughly 80%), while the remaining 20% is mostly mined in Canada and the US. Both countries have just one palladium mine. The US mine is located in Montana, while the Canadian mine is in Ontario.

Only roughly 200,000 kilograms of palladium are mined per year. To put that in perspective, gold is mined at a rate of about 2,500 – 3,000 tonnes per year. Given the only other way to obtain palladium is via highly radioactive nuclear reactor waste that no plant has the equipment to process, the supply is likely to stay limited for the time being.

Because palladium doesn’t have the name recognition of other precious metals and is so rare, it only emerged as a serious contender for collectors and investors alike a few decades ago. Some people prefer to invest in platinum or continue to collect only platinum because they mistake platinum and palladium as the same investment.

It is true that the two are quite similar. Both have a similar silvery-white appearance, and both share the same primary usage (automotive parts and electronics). However, from an investment standpoint, there is one major difference right now—price.

Despite being far rarer than platinum and in extremely limited supply, at one point, palladium was far cheaper. Its ability to function similarly to platinum led some industries to make the switch. Car manufacturers, in particular, took that chance, and, today, upwards of 85% of all palladium mined each year is used to produce catalytic converters.

Interestingly, that, along with issues with the limited palladium mines worldwide, has led the price of palladium to skyrocket, currently above gold, silver, and platinum.

The growing popularity of electric vehicles (which don’t use catalytic converters) and the possibility car makers will switch back to platinum could cause palladium’s value to fall in the future. However, that’s unlikely as both metals are quite rare and have strong demand in a wide range of industries.

Simply put, both platinum and palladium fill a market niche that most other metals can’t, making either option a solid investment. If you can’t decide between one or the other, we recommend both! Our selection includes both palladium and platinum coins and bars.

That said, we do still caution that investing in precious metals does involve some risk. The market is often volatile. In the case of palladium vs. platinum, platinum wins there. While it is often less stable than gold, it’s more stable than palladium, which is more severely affected by even slight production issues as a result of its extreme rarity.

You have the usual options, such as stocks and ETFs, but given the rarity of palladium mines and production operations and that most palladium ETFs indirectly invest in physical palladium anyway, opting for the physical option is often the best choice.

Like other precious metals, that means buying coins and bars. However, unlike more common options like gold and silver, you do have far more limited options.

That’s one reason you don’t see very many palladium coin collectors. This rare metal makes an excellent conversation piece and investment, but you certainly won’t fill a coin display case. Even so, there are a few highly sought-after palladium coins out there.

Want to know more about investing in palladium outside of physical bars and coins? We’ve got you covered! Check out our full guide.

The first palladium coin was minted just over 50 years ago in 1967 in Tonga. Less than 2,000 Tonga Palladium Hau were produced, meaning the coin never really caught on in regular circulation. Even so, today, numerous countries offer some form of palladium coins, including Australia, Canada, China, France, Palau, Portugal, Russia, Slovakia, and the Soviet Union.

We occasionally get coins from all the above in stock, but our best sellers are the Canadian Maple Leaf, Chinese Panda, and American Palladium Eagle.

First issued by the Royal Canadian Mint in 2005, the Canadian Maple Leaf coin had a short run—one of the shortest in Canada’s history. Production stopped in 2007 and resumed in 2009 for the year, resulting in just three release years.

The coins contain one ounce of 99.95% Palladium and are legal tender with a face value of $50. Like all Maple Leaf coins, the palladium version has a maple leaf on the front and Queen Elizabeth II on the back. However, the realistic veining on the leaf itself is a welcome addition—you can literally feel the quality of this coin.

Like Maple Leaf coins, Chinese Pandas are available in multiple metal types: gold, silver, and palladium. The palladium version was released in 1989 by the People’s Bank of China. The front features a different panda design each mint year, and the reverse shows the Temple of Heaven in Beijing.

Despite their annual release (excluding 2001-2003), they are produced in very limited quantities and are one of the few palladium coins popular among collectors.

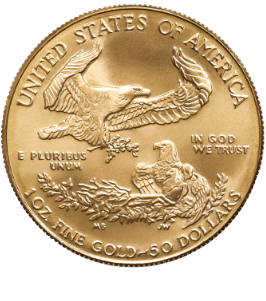

With a face value of $25 and a weight of one ounce, the American Palladium Eagle is the US’s official palladium coin. It was released by the United States Mint in 2017 with a limit of 15,000 each year, excluding 2019 when the limit was doubled. The front features Lady Liberty wearing a winged hat.

The back shows an eagle pulling a laurel branch out of a rock.

While the coins themselves are quite new, the designs aren’t. Adolph A. Weinman designed both sides. He drew the font in 1916 and the back in 1907.

Much like platinum, the best-known palladium bar producers are Credit Suisse and PAMP Suisse. Even so, many private mints release them, such as Engelhard, Johnson Matthey, and Valcambi Suisse. Palladium bars are found in a range of weights, with one ounce being most common, and a few select decorative prints.

Credit Suisse is a Swiss financial institution and mint founded under the name Swiss Credit Institution.

They produce simple palladium bars stamped with their logo, along with the bar’s weight and purity, and follow strict metal purity guidelines.

You can find similar bars from Valcambi Suisse. Both providers are an ideal choice if you aren’t worried about the design of your palladium bars.

If you’re looking for something a bit more artistic, you might consider palladium bars from Swiss company PAMP Suisse. Founded in 1977, PAMP is a world leader in precious metal refinery made famous by their creative designs and high-quality products. They are also one of five Approved Good Delivery Referees recommended by the London Bullion Market Association (LBMA).

Unlike many of their other precious metal bars, PAMP only has one printed palladium bar, which features the lady of luck herself, Fortuna, Greek goddess of fortune. They also mint a cast bar option similar to the bars released by Credit and Valcambi Suisse.

Another provider of printed mints, Johnson Matthey, offers a Lewis & Clark design, which shows famous explorers Meriwether Lewis and William Clark as they traverse the American wilderness on one side. Each bar is one ounce of 99.95% palladium.

Ready to give investing in palladium a try? You can count on our investment experts. We’ve formed partnerships around the world and amassed a massive collection of palladium coins and bars for sale at the lowest possible prices. Don’t see what you were looking for? Get in touch with our team.

We’re more than happy to help you find everything you need and make an informed investment decision—we want to see you reach your goals and achieve a balanced portfolio. When you buy your palladium from Oxford Gold Group, you can trust you’re working with the best.

By clicking the button above, you agree to our Privacy Policy and Terms of Service and authorize Oxford Gold or someone acting on its behalf to contact you by text message, ringless voicemail, or on a recorded line at any telephone or mobile number you provide using automated telephone technology, including auto-dialers, for marketing purposes. No purchase required. Message and data rates may apply. You also agree to receive e-mail marketing from Oxford Gold, our affiliated companies, and third-party advertisers. To opt-out at any time click here or reply STOP to opt-out of text messages.

"*" indicates required fields

"*" indicates required fields

Inside this Free Investment Guide