Table of Contents

Are you thinking of investing in silver? You’ll want to ensure you pay a fair price for your silver bars. The less you pay, the more you stand to gain when you sell. But paying too little could indicate that the silver seller is scamming you.

So, how much do silver bars cost, and how do you determine a fair price? Read below for a complete buyer’s guide.

Factors Affecting Silver Bar Prices

The value of silver bars can fluctuate based on a wide range of factors. Generally, the economy as a whole impacts the price of silver on a day-to-day basis. You can also expect different silver bars to cost different amounts because of their varying purity and weights.

Here are the most prevalent factors impacting the cost of silver bars:

Economic Trends

The ups and downs of the U.S. economy can significantly affect the overall surge to buy or sell silver. Generally, silver and gold sales increase when inflation rates are high. Investors view silver as a hedge against inflation because it retains its value even when the value of paper money decreases.

People may also be more likely to “splurge” on silver bars when the economy trends upward. They may have more cash to contribute to unique investments like silver and gold. When more people buy silver over a designated period, the price will generally rise due to supply and demand.

Supply and Demand

The price of virtually every commodity depends on supply and demand. Silver is a non-renewable resource, which means manufacturers can’t simply produce more when demand is high. High demand generally leads to higher prices because of silver’s limited availability.

On the flip side, the price will generally drop when demand is low — such as when the economy is going through a rough patch and people aren’t investing in precious metals.

Silver Scrap

Advances in technology make silver obsolete for certain applications. For example, silver was once an essential component in photography equipment due to its reflectivity and sensitivity. However, the introduction of digital cameras has made this application less common.

When silver applications no longer become necessary, people can melt the unused silver down as “silver scrap,” allowing more silver to circulate in the markets. The amount of available silver scrap can impact supply, affecting silver prices.

Gold Prices

Gold and silver typically increase and decrease in value at about the same rate. As a result, when gold prices rise, silver prices do as well — at least historically.

The price of gold can fluctuate in response to many of the same factors affecting the price of silver. But gold has less functional use than silver, and jewelry is still the most popular use for this precious metal. As a result, when jewelry markets rise, the price of gold tends to increase.

Silver Bar Purity

The purity of any silver bar you’re considering purchasing can affect its price. The purer a silver bar is, the greater the silver content, leading to a higher price. Always determine the purity of a bar before purchasing it.

Silver Bar Weight

Silver sellers typically price their silver bars by weight. The spot price for silver refers to the current price of silver on the stock market per ounce. An honest seller will multiply the spot price by the ounces of silver in the bar to determine your final price.

Understanding the Market for Silver Bars

Silver bars are the most generic form of silver you can buy. When you purchase a silver bar, your only goal is to own silver. You aren’t also buying a piece of jewelry or a rare coin with value outside its silver content.

As a result, those who buy silver bars (as opposed to jewelry or coins) are generally investors who want to hold on to the silver for a set period of time and then sell it at a higher price. Silver tends to maintain its value over time, acting as an effective hedge against inflation. It’s also a highly liquid asset, as you can easily sell it to online and in-person buyers whenever you think the price is right.

Still, timing your silver purchase right is important to gain the most from your investment. Aside from simply answering, “How much do silver bars cost?” be sure to look at the historical value of silver compared to the time you’re considering buying it.

If silver costs more now than it did a few months ago, you may want to wait until the silver market stabilizes. Meanwhile, if silver is cheaper now than it usually is, you may want to buy more than you originally planned.

Different Types of Silver Bars

Not all silver bars are created equal. You should understand the different types of bars available on the precious metals market to make a more informed investment decision.

Generally, you can separate silver bars into two categories: minted and poured/cast.

Minted silver bars are pressed out of a large sheet of silver. This is a fast process that can extrude dozens of silver bars quickly.

Meanwhile, poured or cast silver bars involve a more tedious process. A manufacturer pours a precise amount of molten silver into a mold made of graphite or steel, allowing it to cool and take on the characteristic shape that collectors prize so highly.

Because poured silver bars take longer to make, they usually fetch a higher premium. Poured or cast bars also have a more rugged or textured look, while minted bars look more uniform.

Always pay attention to the company that produced the silver bar. Reputable names may command a higher premium because consumers can trust that the silver bars contain the right silver content. A few reliable brands include Royal Canadian Mint, Johnson Matthey, PAMP Suisse, and Engelhard.

While you may pay more for a silver bar from a reliable brand, you’ll probably be able to sell it at a higher price and sell it faster than you could with a lower-quality option.

Weight and Purity of Silver Bars

Silver bars come in various weights and purities. Typically, you can find the following weights:

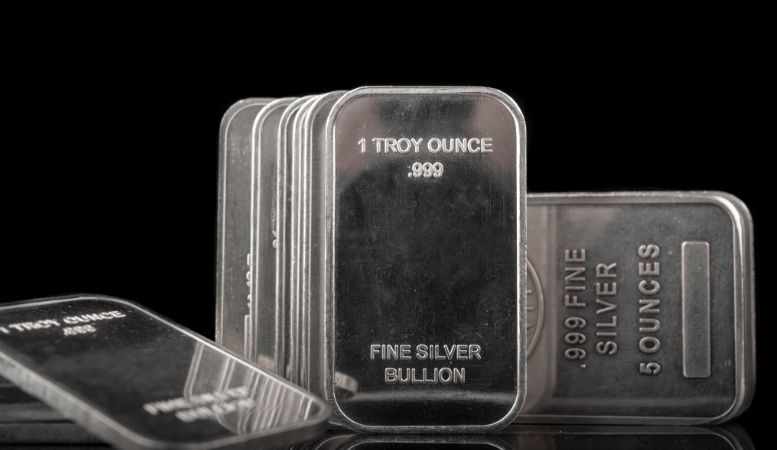

- One ounce

- Five ounces

- 10 ounces

- 100 ounces

One-ounce and five-ounce silver bars are the most common.

A silver bar’s purity refers to the percentage of silver within the bar. Investment-grade silver is 99.9% pure (sometimes written as .999), which means it only contains .1% of other materials.

Historical Trends in Silver Bar Prices

The price of silver goes up and does so in the short term, but looking at average long-term trends reveals that its value has historically increased overall.

In the 1920s through the 1950s, the spot price of silver hovered around a few dollars per ounce. It spiked in the mid-1980s to about $25 per ounce, then dipped below $10 in the 1990s.

The largest increase in the spot price of silver in the past century occurred in 2011 when the price reached an all-time high of $40 per troy ounce. In 2012, the price of silver began to fall again, plateauing around $20 in the late 2010s.

So, how much do silver bars cost now? In 2023, the spot price of silver will range between $25 and $30 per troy ounce.

Buying Silver Bars for Sale by Authorized Dealers

Knowing the different factors impacting the price of silver can help you find a seller charging a fair price. You also must ensure you purchase your silver bars from an authorized dealer instead of just a random seller on the street.

You can check the reliability of a seller by doing the following:

- Reading their online reviews

- Reviewing their prices — they should be pretty close to the spot price

- Determining whether they have any special licenses to sell in your state

The easiest way to buy silver reliably is through an online dealer with a long-standing industry reputation, like Oxford Gold Group.

Selling Silver Bars and Getting the Best Value

When it comes time to cash out your silver investment, whether in one or 50 years, don’t settle for anything less than the best value at the time.

Review the current spot price of silver (indicated as SIN23 on the market) and ensure your buyer at least matches that price. Then, consider any special features that could increase the value of your silver bars, such as coming from a reputable assayer or being poured instead of minted.

Tips for Investing in Silver Bars

Now that you know the answer to “How much do silver bars cost?” review the following tips to make the most of your silver investment:

- Store your silver bars in a reputable depository

- Hold on to your silver until its spot price is considerably higher than your purchase price

- Talk to your financial advisor for investment guidance

- Start with smaller silver bars and work your way up

Are you ready to buy silver? Check out our silver inventory at Oxford Gold Group today.