Precious metals have shown signs of a resurgence, but could a relationship with the dollar and treasuries provide the clue that silver is on the cusp of a major move higher?

Gold and silver uptrend kicking back into gear

The long-term uptrend for gold and silver had been called into question over the course of the past four months, with the price of these precious metals losing a significant amount of ground despite their long-term uptrends.

The question over whether that uptrend was over remains prominent for many, with the reasoning behind a risk-off move into these perceived haven assets weakened after the release of positive vaccine updates from Pfizer, Moderna, and AstraZeneca.

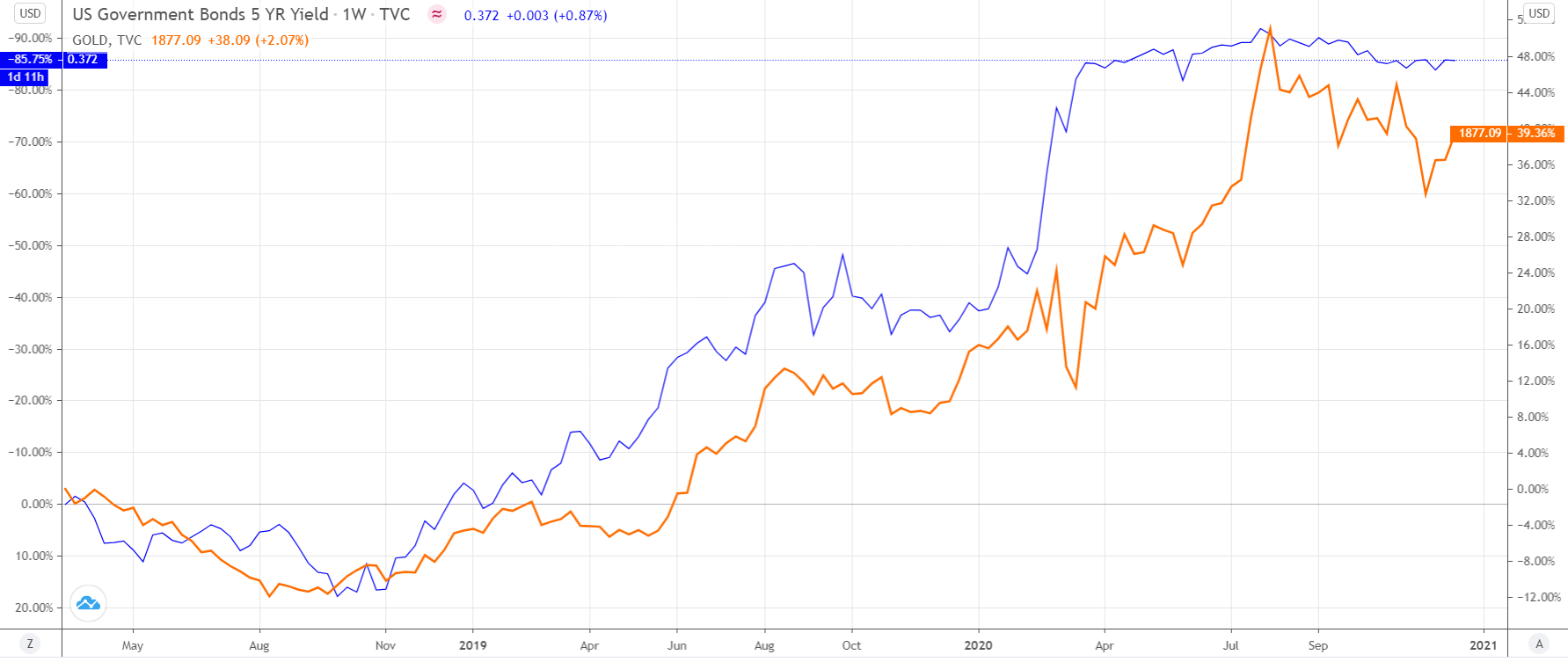

Nevertheless, with the prices pushing sharply higher over the course of December thus far, there is a good chance we will see that long-term uptrend come back into play once more. The chart below highlights the relationship between gold and the US 5 year yield (inverted).

While we have been looking at gold diverge from the more stable treasury pricing, it does highlight the potential for a rise in gold which would drive convergence for these two markets.

Dollar highlights potential for silver outperformance

While the image above does provide a compelling case for a gold recovery, the question should perhaps be centred around whether gold is in fact the best market to trade for such a recovery.

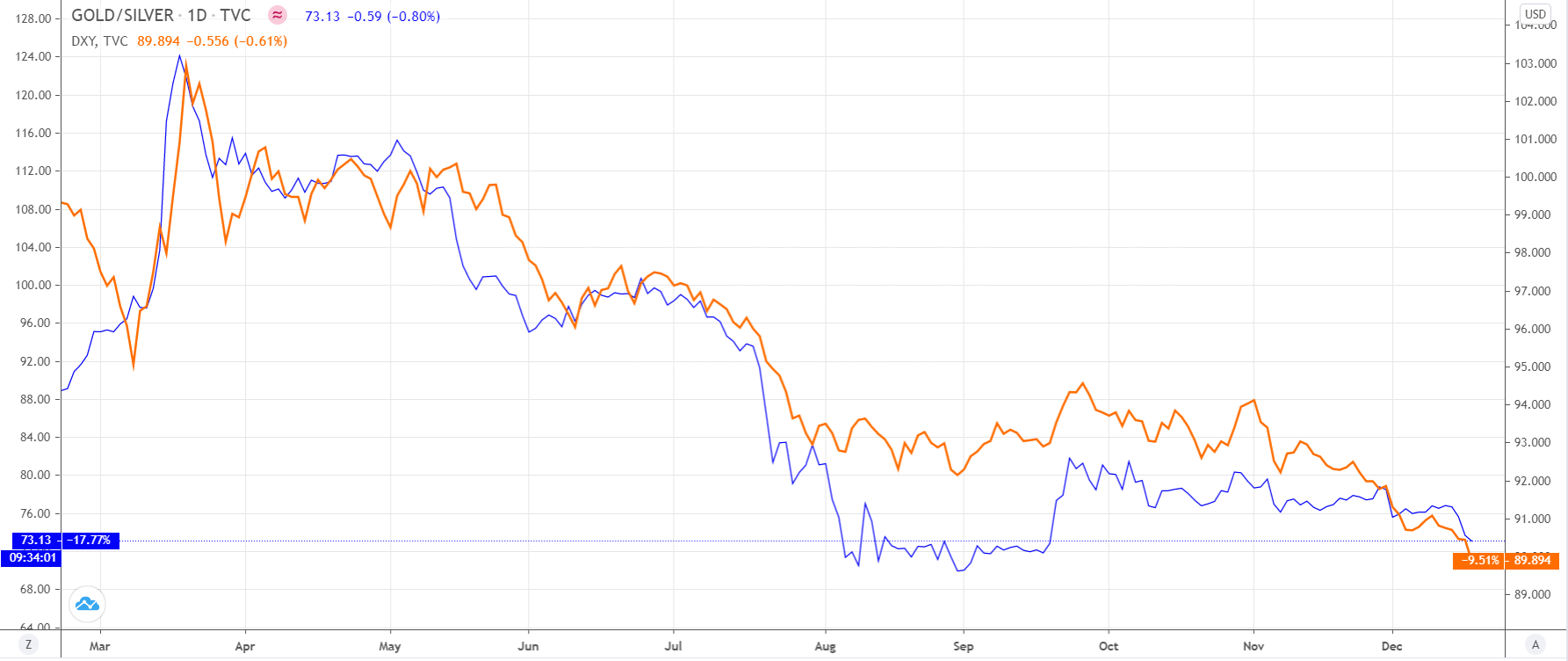

Silver is to gold what ethereum is to bitcoin. Typically we see greater volatility for silver, yet it can outperform in times of market confidence. That is highlighted perfectly by the chart below, with the dollar index perfectly moving in tandem with the gold/silver ratio.

Given the widespread perception that the dollar is a haven asset, a decline in the dollar highlights a move into riskier assets over safer bets.

Thus it should not necessarily surprise us that silver outperforms as the traders look for risk. With that in mind, the dollar decline forecast by many for 2021 could bring significant outperformance for the price of silver.

Silver looks to have plenty left in the tank

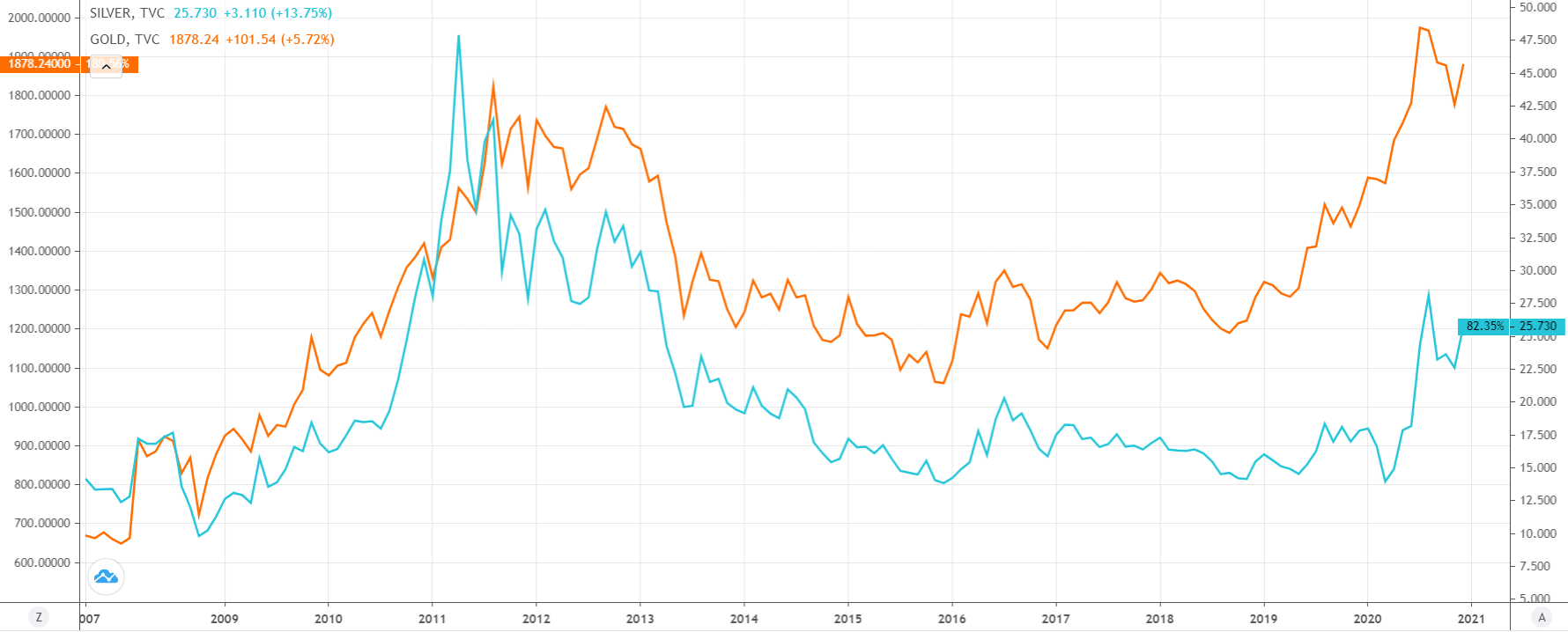

A look at the long-term trajectory for gold and silver highlights the major underperformance of the latter compared with the last post-crisis period.

It is also worthwhile noting that the period following the 2007 financial crisis was particularly positive for both markets, with the price of gold and silver topping out some years later in 2011.

That does provide some hope for traders, although it is notable that the monetary response was relatively drawn out compared to the front-loaded global response this time around.

In any case, this chart does serve to highlight the very different position each market finds itself in. Gold is currently trading some 2% below that 2011 high. Meanwhile, silver is a significant 48% down on that peak.

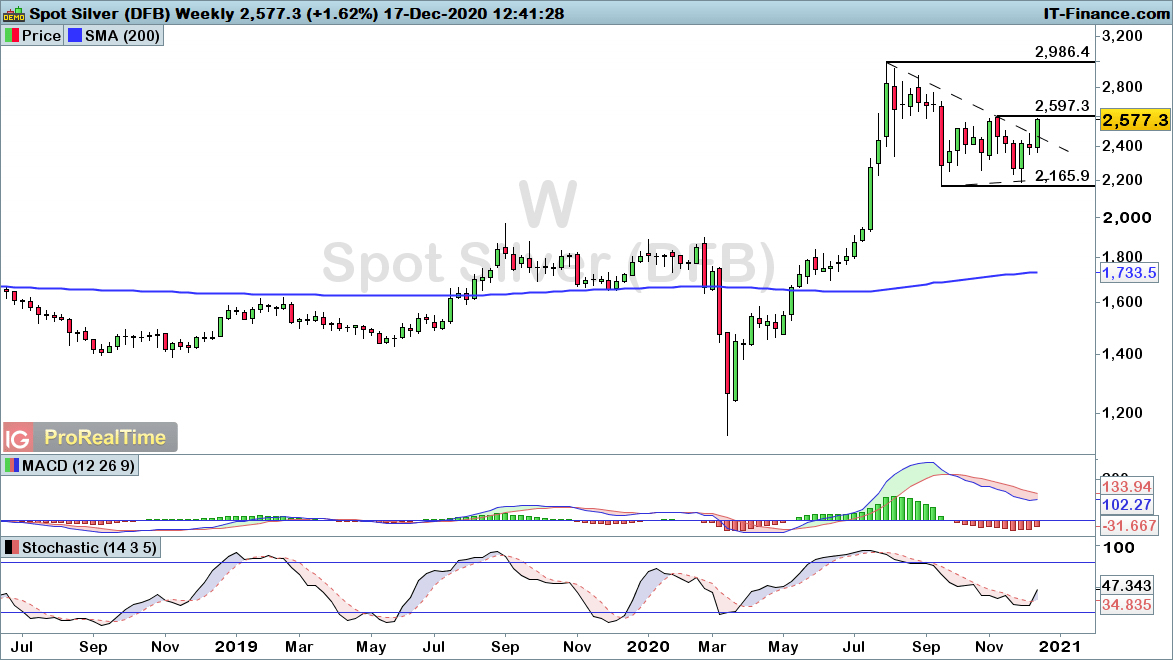

Silver primed for next leg higher

The weekly silver chart highlights the strength of this current move, with price heading towards the $25.97 resistance level.

That swing high is a key level to watch, with an upside break providing a fresh bullish signal following a four-month period of consolidation.

With all the signals pointing towards potential silver outperformance from here, it looks likely we could be on our way to a new period of strength for this often overlooked precious metal.