It has been a rough September for the stock market, with the S&P 500 SPX down over 7% so far.

In its comprehensive look at markets, Citi’s global asset allocation team doesn’t expect the sailing to get any easier, as it fears for the coming U.S. election. “A political process that cannot accurately ascertain its leader, parties refusing to accept results and potential social disorder, all damage credibility and lower the confidence of investors, especially in light of everything else happening in the background. Challenge to the rule of law would lead to a reassessment of historically ‘safe’ U.S. assets (including U.S. Treasurys and the U.S. dollar) even if only temporary,” the strategists say.

The next phase of COVID-19 related stimulus is likely to be a casualty of the Supreme Court vacancy, the strategists add (more on that below). As the Northern Hemisphere enters the colder autumn period, an increase in cases is becoming evident, which both may alter human behavior as well as government reactions, both of which could weigh on economic activity.

The Citi team does acknowledge the “central bank put remains intrinsically tied to the equity market,” and that there will be more Treasury bond and credit purchases, and a desire to keep inflation-adjusted interest rates well below 1%.

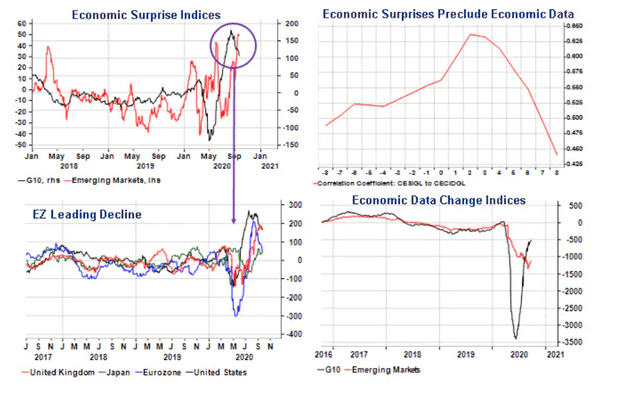

With all that as a backdrop, the Citi team says “it makes sense to trim some developed market specific risk at a time when near-term probabilities are skewed to some regional [economic surprises] turning negative again, led by Europe.” It advises rotating from European to emerging-market equities EEM, where it is overweight for the first time since the COVID-19 crisis. Fundamentals for the dollar DXY will remain unsupportive over the medium term, which will be another positive for emerging-market equities, the strategists add.