Table of Contents

When asking, “Why is gold valuable?” people often don’t realize the deep historical relationship between humans and gold, both as an alluring material to make objects of beauty and also as a valuable commodity. Notably, gold mining and production have been significant elements in both industry and international trade between ancient civilizations as well as modern.

Some people may wonder how much gold is in the U.S. Gold Reserves and if investing in physical gold is a better strategy than other investment options. While paper money once held value by the gold standard, why does the value now fluctuate based on global fiat relationships between multiple countries?

In this article from our experts at The Oxford Gold Group, you’ll learn more about the value of gold and its history, uses, and more.

The Gold Standard

The U.S. gold standard links our nation’s currency and wealth directly to the value of gold, whether in minting gold coins or printing paper money backed by its face value in gold.

In 1792, Congress enacted a gold and silver parity policy with a ratio of 1:15 to reflect the current market value of the time. The Coinage Act of 1834 effectively pushed the U.S. to a real gold standard.

After the international adoption of the gold standard in the late 19th century, the value of gold remained relatively unchanged through several major political and economic events in the first half of the 20th century, including the First World War and Great Depression. However, several countries attempted to raise interest rates rather than deplete their gold stock. Many countries had suspended their gold standards by 1931, including England.

In 1934, the U.S. increased the value of one ounce of gold from $20.67 to $35. Upon the signing of the Bretton Woods Agreement in July 1944 until 1971, the dollar became the dominant global reserve currency with other nations pegging their currencies to the U.S. Dollar.

The primary issue with the gold standard is the relative scarcity of gold makes it difficult to keep up with demand. If everyone holding paper money at the time of a major economic event decided to trade it for gold at the same time, financial institutions would not be able to exchange everyone’s dollars.

What Factors Affect the Value of Pure Gold?

There are many reasons investors choose gold coins and physical gold as stable investments over time. The value of gold remains relatively the same, with fewer fluctuations than fiat currency.

Inflation

Many investors consider gold a safe investment because the value remains relatively stable, even during periods of high inflation or attempted devaluation. While the governments control the value of fiat currencies, making them subject to inflation or deflation, gold remains a valuable commodity during periods of economic instability.

Rarity

The relative scarcity of gold compared to other precious metals makes it the perfect option for currency, while still being common enough for minting and trading. Other precious metals like platinum, palladium, and iridium have a higher value than gold because they are even rarer than gold.

However, for a rare metal to have value as currency, it must be available in a great enough quantity to produce coins for circulation.

Durability and Malleability

Other metals, like iron, copper, aluminum, or lead, are more common but are also unsuitable for currency due to their propensity to corrode over time. Gold is a noble metal that doesn’t react with other substances or metals, like alkaline metals.

The chemical symbol for gold is Au, and it is the 79th element on the periodic table. Its unique properties make it extremely durable. Gold never corrodes and can maintain its luster and color for years with little to no maintenance, making it a perfect candidate for long-term storage.

Pure gold is very soft and easily shaped, with a low melting point. The flexibility and durability of gold have made it an excellent material for coins, jewelry, dental fillings, circuit boards, and more.

Aesthetic Value

Since ancient times, people have worshiped the aesthetic properties of gold. Jewelers, artists, and governments have used both gold and silver to create jewelry, art, decorative items, and coins. Although silver tarnishes over time, gold remains lustrous and beautiful.

Even gold stored in vaults as gold bars, bullion, or coins will keep its shine due to gold’s chemical properties as a non-reactive precious metal.

Demand Across Multiple Industries

With a limited supply of gold available, mined from the earth’s crust, gold’s usefulness in numerous industrial applications makes gold valuable in manufacturing. Besides fashioning jewelry and decorative items, gold is also essential to modern companies for computer circuit boards, satellites, dental caps and fillings, astronauts’ helmets, telescopes, window coatings, and trendy desserts.

History of Gold: Space Rocks and Our Ancient Ancestors

Abundant metal exists in the earth’s core, including iron, platinum, and gold. The core contains enough metal to cover the surface of the earth in a solid four-meter layer. However, we can’t mine the core, so we must rely on what materials we can find beneath the crust. All the gold on earth that we can mine comes from ancient meteorites that landed on our planet over 200 million years after the formation of the planet.

Humans first discovered gold around 8,000 years ago in Asia Minor and the Middle East, around modern-day Turkey. By 2,000 BCE, the Ancient Egyptians had gold mines.

Many ancient civilizations smelted and mixed gold into alloys to make valuable jewelry, including alloys of gold and silver (electrum) that the Egyptians used in jewelry-making as early as 5,000 BCE. Archaeologists and anthropologists also credit King Croesus of Lydia with the first gold coins during his reign between 561 and 546 BCE.

The ancient Incan civilization lived on the western edge of South America in what is now Peru. The Incans associated gold with the sun god Inti and used it to create religious ceremonial pieces.

Many ancient civilizations used gold for decorative purposes. Originally sought for its intrinsic value, gold eventually became a valuable commodity, attracting the attention of pirates, merchants, and kings to seek their next gold score in raids, trades, and crusades.

Why Gold Has More Value Than Other Precious Metals

How much gold has gold mining extracted from the ground? According to the U.S. Department of the Interior’s Geological Survey (USGS), 187,000 metric tons of gold have historically gone through mining and gold production, with known gold reserves estimated at 57,000 metric tons. China, Australia, and South Africa lead in gold production.

Gold is usually weighed in a quantity called a troy ounce (31.1 grams). The U.S. has approximately 2.3 billion troy ounces of gold stored in vaults secured by the U.S. Treasury Department.

But why is gold valuable? And why does it have more purchasing power than other metals? Since ancient times, people have held gold in high regard compared to silver and other metals. Besides being rare, brilliant, malleable, and beautiful, humans are emotionally drawn to gold after thousands of years of considering gold valuable.

Other properties of gold include electrical conductivity and the ability to reflect light and heat away from gold-leaf-coated surfaces. This is why gold is valuable to modern companies in aeronautics, electronics, engineering, medicine, and dentistry.

Many investors prefer investing in gold over other investments because gold prices may fluctuate but usually remain sustainable. Silver, stocks, and other assets often offer a more affordable price of entry but are also more volatile and pose a higher risk.

Other Forms of Gold and Their Uses

Gold is a popular material for art, fashion, medicine, and aerospace engineering, as well as investing in it to diversify a portfolio and protect against the risk of other assets. As such, several industries hold gold in high regard as a workable material for their products.

Jewelry, Fashion, and Art

Since humans started using gold, we have made jewelry and decorative items to adorn our bodies. Ancient people wove threads of gold into fabric and made elaborate earrings, necklaces, bodices, bracelets, funeral masks, and religious ceremonial garb.

Many jewelers since antiquity have smelted gold together with silver and other metals to strengthen the soft gold and make it hold its shape and affect the color of the final pieces.

Artists often use gold leaf in paintings, sculpt with gold alloys, and create decorative items for homes, religious structures, and political buildings. There’s also a current trend in high-end food service to add gold leaf or gold flakes in desserts, entrees, cocktails, and other dishes to attract food influencers for popular marketing.

The popularity of real gold, as well as silver and gold combinations, in art, jewelry, and fashion, increases the demand for more gold.

Aeronautics and Architecture

Gold is highly reflective and malleable. Aerospace manufacturers can pound gold super-thin to make reflective coatings for space suit helmet shields, satellite panels, plane windows, and more. Because gold is also non-corrosive, engineers may apply thin sheets of gold to exposed metal parts on planes, spaceships, planetary rovers, and deep-space telescopes to repel damage from alien environments.

Engineers may also coat glass with gold (or infuse gold into glass) for green building architecture, climate-controlled glass cases, and other uses. The Mandalay Bay in Las Vegas has gold-coated windows for improved energy efficiency against the scorching desert sun.

Medicine and Dentistry

Gold is hygienic, inert, hypoallergenic, and malleable enough for dentists to easily shape into fillings, crowns, and other forms. Dentists have used gold in dentistry since approximately 700 BCE, when Etruscan dental physicians would wire animal teeth replacements into a patient’s mouth with gold wire.

While gold dental fillings and other tools were popular, the increase in gold prices in the early 1970s proved too much for many dentists, who developed replacement materials for fillings, caps, and crowns. However, many dentists are now ordering gold products again as concerns rise about adverse effects from the substitute materials.

Gold is also useful in the medical diagnosis and treatment of specific conditions. For diagnosis of some conditions, radiologists inject a radioactive isotope of gold and track beta emissions. Doctors may also treat some cancers by implanting a radioactive gold isotope in the affected tissues to provide continuous radiation treatment.

Doctors have also implanted small amounts of gold in patients’ eyelids to treat lagophthalmos, an inability to close the eyelids. This condition often affects people with Bell’s Palsy or facial paralysis. None of the gold treatments contain large quantities of gold, and the stable, sanitary, and workable material is perfect for upholding certain medical safety regulations.

Electronics

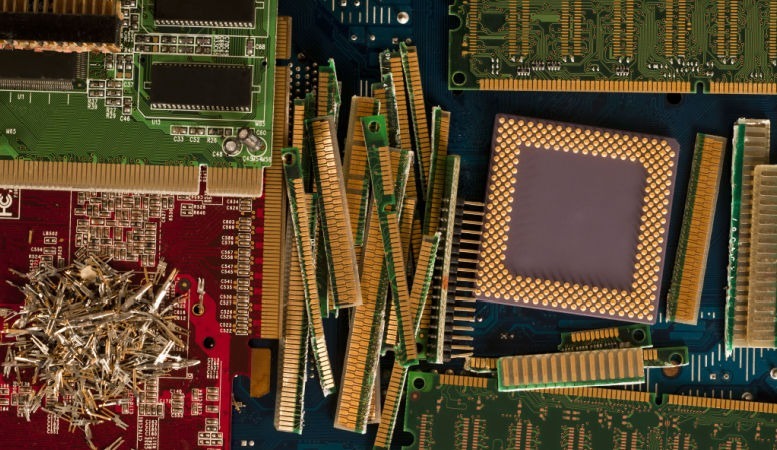

Electronic circuits can experience interruptions in currents if tarnishing or corrosion breaks the path. This is why gold is popular for soldering points, relay contacts, switches, connectors, and other essential pathway connections.

Gold doesn’t tarnish or corrode, and is an excellent conductor for electrical currents and data transfers. Many household devices contain gold, including phones, GPS devices, televisions, computers, and more. Most computers use an alloy of gold and nickel or cobalt for motherboards, memory sticks, and connecting cables.

Hedging Investments Against Inflation

Many investors wish to diversify their portfolios with currency investments, stocks, IRAs, cryptocurrency, and gold or silver. While gold prices can deter many from entering the gold investment market, gold is often more stable than silver or other assets.

Gold will always be a valuable commodity, even when gold prices fall. The volatility of other investments like silver or stocks can make them less favorable options, even at a lower entry cost.

Investors often choose gold when they don’t feel confident in the U.S. dollar or other currency or feel the stock market is too risky and won’t stabilize again for a while. They may also opt for gold investments when concerned about inflation.

As the costs of goods rise, the dollar devalues. The price of gold often runs inverse to the value of the dollar, and investing in gold can pay off during periods of high inflation.

The Benefits of Investing in Gold and Gold Coins

Gold has appreciated for nearly 6,000 years and can become the foundation of generational wealth for many families. The outlook for gold points to more money for an investor and their descendants as a stable hedge against international conflict, stock market crashes, inflation, and supply chain disruptions.

Since the Nixon administration abandoned the gold standard in 1971, the value of the dollar has fallen nearly 98%. In 1971, the price for one ounce of gold was $35, whereas, at the time of writing this article, the price was approximately $1,655. The dollar now has a little more than 2% of its 1971 value against gold.

Pure gold is stable, stores well, and doesn’t corrode or tarnish. For more information, contact us at the Oxford Gold Group at 855-935-5674 or get your free investment guide online.