Table of Contents

American coins have a fascinating history, starting with the Mint Act and spanning over two centuries of pivotal moments, economic shifts, and often controversial legislation. In different years, government policies determined how national coins would look and impacted the value of gold and silver.

Let’s look at six major U.S. Coinage Acts to understand how they influenced American currency.

The Birth of U.S. Coinage and Currency: The Coinage Act of 1792

Before America had its own coinage, foreign currency like the Spanish dollar circulated in the colonies, sometimes along with colonial paper money.

Sixteen years after the Declaration of Independence, the Coinage Act of 1792, a.k.a. the Mint Act, established the U.S. dollar as the national currency unit and declared the United States Mint the maker of U.S. coins.

The Mint Act helped confirm the U.S. as a separate financial entity independent of British currency. The first of the U.S. Coinage Acts also:

- Confirmed the bimetallic monetary system recognizing silver and gold for legal tender coins

- Standardized the weight and metal content of different coins

- Established standard coin denominations (like dollars, quarters, and cents)

- Named the dollar as a national basic currency unit

- Fixed the gold-to-silver price ratio at 1:15

Establishment of the U.S. Mint

The Coinage Act of 1792 also established the first national mint in Philadelphia, then the capital. President George Washington appointed David Rittenhouse, a famous scientist and inventor, as the mint’s first director. In 1793, the Philadelphia Mint released the first American circulating coins.

Under the first Coinage Act, any person could have gold or silver bullion turned into coins at the national mint or exchange bullion for coins, with a charge of under 0.5% of the pure bullion’s weight. Debasement or embezzlement of silver or gold coins from the mint was a crime subject to the death penalty.

The First National Coinage

The list of the first standardized national coins and their metal content is as follows:

- Eagles: $10 gold coins containing 17.5 grams of pure gold

- Half Eagles: $5 gold coins with 8.75 grams of pure gold

- Quarter Eagles: $2.5 coins containing 4.37 grams of standard gold

- Dollars: $1 coins with 27 grams of standard silver

- Half Dollars: $0.5 coins with 13.5 grams of standard silver

- Quarter Dollars: $0.25 coins with a standard silver content of 6.74 grams

- Dimes (then spelled “dismes”): $0.1 coins containing 2.7 grams of silver

- Half Dimes: $0.05 coins with 1.35 grams of standard silver

- Cents: $0.01 coins containing 17.1 grams of copper

- Half Cents: $0.005 coins containing 8.55 grams of copper

The Mint Act also dictated the design of national coins. Each coin would feature the word “Liberty” with a symbolic image on the obverse, along with its year of mint. Gold and silver coins would bear the words “United States of America” and an image of an eagle on their reverse side.

The first silver dollar, minted in 1794, became one of the most iconic U.S. coins in history. It featured the well-known design of Dame Liberty with flowing hair on the obverse and an eagle spreading its wings on the reverse.

The Coinage Act of 1834

The second of the U.S. Coinage Acts passed on June 27, 1834. Under this act, the gold-to-silver value ratio changed from 1:15 to 1:16, thus pushing down silver’s mint price below international market levels.

This undervaluing of silver led to the exportation of silver to Europe, where it could fetch a higher price. The number of silver coins in circulation dropped dramatically, and many banks started issuing paper currency in small denominations.

The Coinage Act of 1834 also reduced the gold content of the Eagle by approximately 7% (from 247.5 to 232 grains of gold) and paved the way to the gold standard. Meanwhile, the silver dollar remained at the same pure silver content.

The Coinage Act of 1849

The Coinage Act of 1849 was passed after the start of the California Gold Rush in 1848. This act created two new gold coin denominations in response to the boost in gold supply: the Gold Dollar and the Double Eagle, the latter worth $20.

The establishment of the gold dollar was an attempt to replace disappearing silver coins while gold continued to outstrip silver in value. However, this coin never gained popularity because of its small size, which made it difficult to handle and easy to lose. Moreover, its comparatively high denomination was inconvenient for retail trade.

The Coinage Act of 1857

The Coinage Act of 1857 introduced several changes to American currency. The most significant was stripping all foreign coins of their status as legal tender. American citizens who owned foreign gold or silver coins could exchange them or have them recoined.

This act made a deep and lasting impact on the American economy. Businesses that used to accept recognized foreign currency switched to making transactions only in American coins with a U.S. government seal. Essentially, from this point onward, the U.S. government gained total control over the money supply.

The same Coinage Act also fixed the weight of one-cent coins at 4.655 grams. The standard composition of one-cent pieces would be an alloy containing 88% copper and 12% nickel.

The Coinage Act of 1873

The most controversial of all U.S. Coinage Acts was possibly that of 1873. This act abolished the bimetallic system, forced the gold standard, and demonetized silver. The same act also introduced a trade dollar meant for export and removed some small-denomination coins from circulation.

Opponents of the gold standard dubbed this coinage act “the Crime of ’73” and criticized it for the instability it could introduce to the economy.

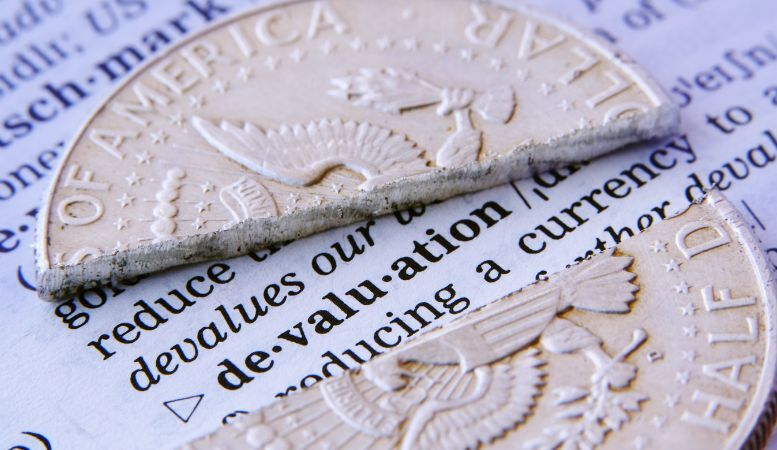

Until the Coinage Act of 1873, Americans who held silver bullion could have it made into silver dollars. The act ended this provision while allowing gold holders to coin bullion into money. This devalued silver, and many silver holders suffered significant losses.

The Coinage Act of 1965

The Coinage Act of 1965 shaped American coins as we know them today. This act removed silver from quarters and dimes and reduced the silver content of half dollars from 90% to 40%. A follow-up law of 1970 eliminated the silver in half dollars.

This coinage act resulted from coin shortages that began in 1959 and grew in the early 1960s in response to increased demand for silver. The price of silver climbed until bullion prices threatened to outstrip the value of silver coins. People were hoarding silver coins, and the shortages continued despite efforts by the United States Mint to increase production.

With government silver stocks rapidly dwindling, Congress passed legislation introducing quarters and dimes without silver and half dollars with reduced silver content. The new coins entered circulation in 1965, relieving the shortages.

Buy Quality Gold and Silver Coins From Oxford Gold Group

Despite losing their status as everyday circulating currency, gold and silver legal tender coins have retained their popularity with investors. Precious metals remain stable assets that have stood the test of time, even following the different U.S. Coinage Acts throughout history.

If you’re looking into buying gold and silver coins, check out the selection of high-quality precious metal products at Oxford Gold Group. Also, remember to claim our free Complete Precious Metals Investment Guide.