Entering the world of precious metal investing isn’t as hard as it seems. We have worked hard to make our process as simple, enjoyable, and intuitive as possible, and it shows.

You will be able to deposit your funds into your new Gold IRA account, which we'll help you set up once you begin working with us.

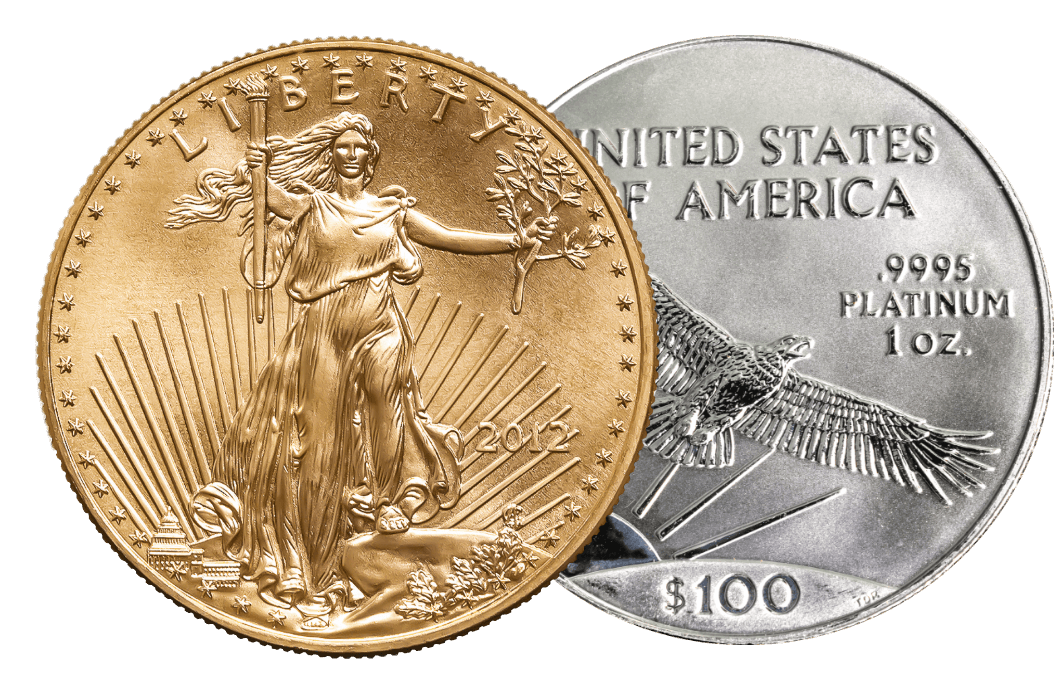

You choose which precious metals to invest in with your deposited funds and we accurately convert them.

We deliver your investment straight to your doorstep in safe and secure packaging for you to retrieve.

Your schedule is likely packed to the brim with obligations, so we offer a multitude of time slots. We’d love to take your call whenever you are available so we can discuss your future.

I contacted Oxford Gold Group because I was in the market to purchase precious metals. I chose Oxford Gold Group because they were willing to take the time to educate me on the process, and for me this was the most valuable part. I never felt pushed or hurried along just to make a sale. They took the time to explain how it’s done, what to expect and made sure I understood that this was a long term investment and not a short term investment.

JAMES W.

I started the process with Oxford Gold Group a few months back. The representative that I spoke with was really awesome, extremely knowledgeable, offered no pressure service and I really feel I made a good decision based on the information I was given. I was semi confident in the knowledge I had about investing in precious metals, however the representatives were extremely educational and did not try to sway me one, way or the other.

EDWARD N.

By clicking the button above, you agree to our Privacy Policy and Terms of Service and authorize Oxford Gold or someone acting on its behalf to contact you by text message, ringless voicemail, or on a recorded line at any telephone or mobile number you provide using automated telephone technology, including auto-dialers, for marketing purposes. No purchase required. Message and data rates may apply. You also agree to receive e-mail marketing from Oxford Gold, our affiliated companies, and third-party advertisers. To opt-out at any time click here or reply STOP to opt-out of text messages.

"*" indicates required fields

"*" indicates required fields

Inside this Free Investment Guide