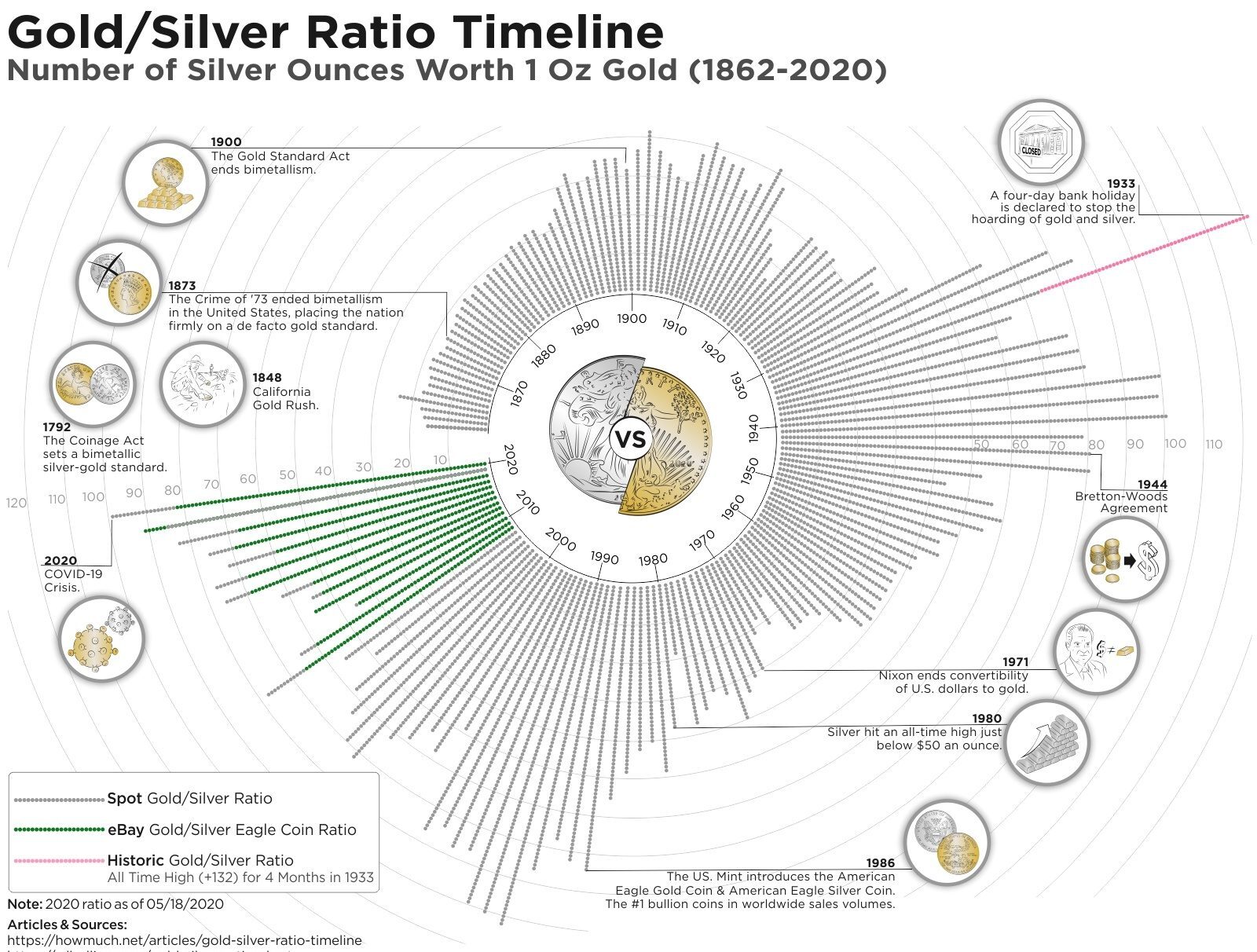

On March 18, the gold-silver ratio, which simply shows how many ounces of silver it takes to buy one ounce of gold, reached an extreme high of 126.43. At the time, Marshall Gittler of BDSwiss, said it was the highest level that number has reached in 5,120 years.

Dialing all the way back to ancient Egypt, the ratio was merely 2.5. It had risen to 6 during the King Hammurabi era in Babylon. Fast forward thousands of years and the ratio had dropped from its lofty March perch but was still around 100, the third-highest level of any year since 1862.

Cost-estimating website HowMuch.net, in conjuction with SD Bullion, used all the data over those 158 years to come up with this visual tour of what the ratio has done in that time period:

Generally, the ratio tends to see a rise during uncertain times as investors latch on to gold GC00, 1.40% — and if ever there were uncertain times, the past few months certainly qualify. But if an investor believes that there will be a reversion to historical norms, then silver SI00, 1.78% would have to look like an attractive option here.

“Silver is at a good range to begin accumulating a little at a time,” Anthony Allen Anderson of GSI Exchange recently wrote. “You might have to wait a bit to see silver prices rise, but again, this is not about short-term trading. This is about taking advantage of a never-before-seen ratio level and, of course, accumulating a ‘sound money’ and safe-haven asset at a relatively cheap price.”

He explained that a driving factor for the spike in the ratio is the prevailing preference for gold as a hedge over silver during downturns, but he also said that when things turn around, it won’t just be a risk-on draw away from gold that makes this ratio retreat.

“Silver is also an industrial metal in addition to being a precious metal,” Anderson said. “The wheels of industry tend to ramp up as economies recover from recessionary slumps. And when industry ramps up, so does the demand for silver’s industrial consumption.”

Here’s a look at how the two have performed so far this year, relative to the S&P:

Meanwhile, safe havens were looking pretty good Monday as the Dow DJIA, 0.17%, S&P SPX, 0.18% SPX, 0.18% and Nasdaq COMP, 0.32% all moved lower to start the week.