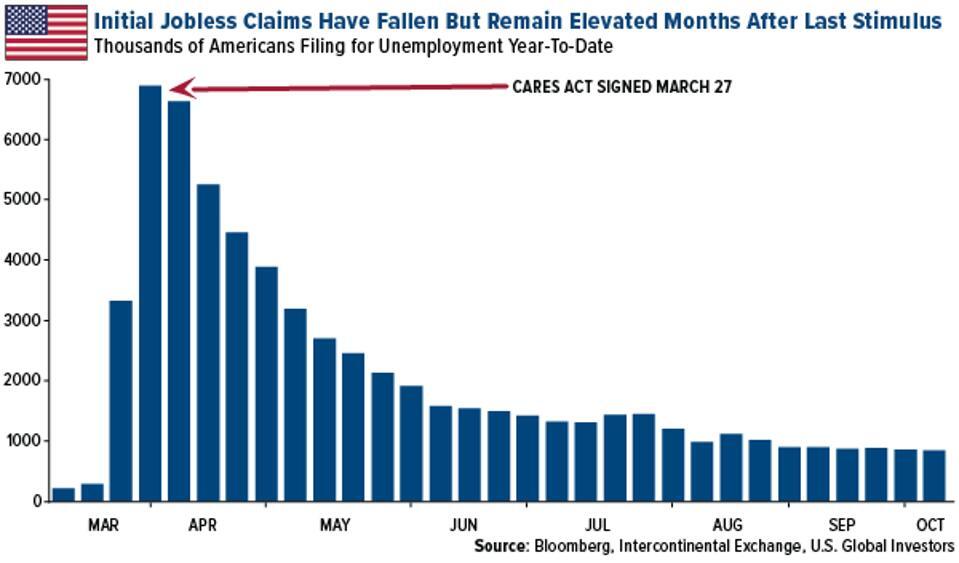

The Wall Street Journal reported on Friday that the White House is preparing a coronavirus stimulus offer valued at $1.8 trillion, despite President Trump’s earlier comment on ending negotiations. It’s been seven months since the last relief package, the CARES Act, was signed, and in that time, the number of Americans filing for jobless benefits has remained elevated.

U.S. GLOBAL INVESTORS

With the national debt now topping $27 trillion, such a package isn’t good for the government’s balance sheet, but it’s good for gold. Indeed, the yellow metal traded up as much as 1.8 percent on the news.

And I believe there’s additional upside potential—no matter who wins the election. In 22 days, millions of Americans will be betting on “red,” millions of others on “blue.” I’ll be betting on gold.

I’m far from the only one. Leon Cooperman became just the latest billionaire investor to buy gold. In a recent interview, the Omega Advisors chairman and CEO said: “I bought gold for the first time in my life a week ago. I understand the case for gold. We’re on the way to some banana republic situation. Nobody’s worrying about the debt that’s being created.”

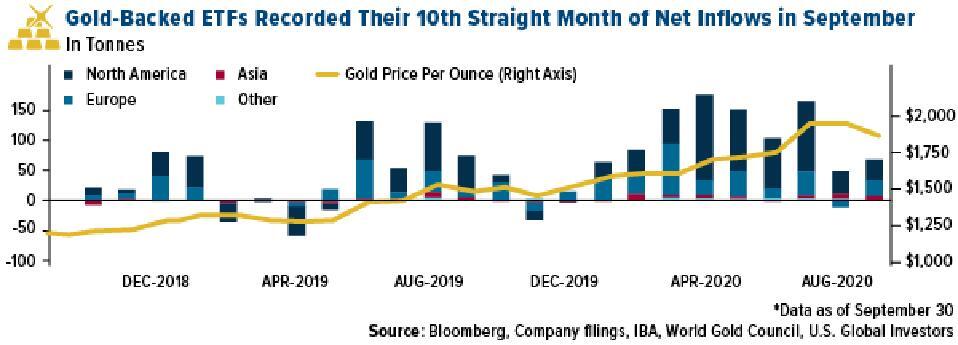

Meanwhile, ETFs backed by physical gold climbed to a record amount last Monday, touching 111.05 million ounces. According to the World Gold Council’s (WGC) September report, global gold ETFs saw their 10th straight month of inflows last month. For the first time ever, such funds added more than 1,000 tonnes of gold so far this year, the equivalent of $55.7 billion.

U.S. GLOBAL INVESTORS

Gold Miners to Report “Most Unbelievable Margins”

Then there’s gold mining stocks. Companies in the NYSE Arca Gold Miners Index put in a strong showing on Friday, finishing the session up 4.2 percent, its best single-day jump since August 17. For the week, the group advanced more than 4 percent.

Like the metal they mine, gold producers could see an even bigger jump when they begin to report third-quarter earnings. With gold having averaged $1,911 an ounce during the quarter, and hitting its all-time high of $2,070 in early August, producers generated some of the highest revenues they’ve ever experienced, not to mention margins.

That was the message of my friend Pierre Lassonde, speaking to Kitco News last month. The legendary co-founder of Franco-Nevada said that “gold miners have never had it so good,” explaining that the “margins they are producing are the fattest, the best, the absolute unbelievable margins they’ve ever had.”

An explosion in exploration activity could take place as a result, according to Pierre. “I think the budgets will be up more likely by 50 percent to 75 percent” in 2021, he said.

It’s not too late to participate!

Forbes.com – Frank Holmes – Contributor – Great Speculations – Contributor Group – Markets