The precious metal climbed above $2000 on Tuesday and looks capable finding support at that level after hitting a high of $2075 earlier this month, with analysts from Citigroup believing it could top $2500 an ounce.

The value of the US dollar continues to fall as a result of Donald Trump’s poor response to the coronavirus pandemic, with the greenback devaluing to the point where its close to losing its standing as a world reserve currency.

As a consequence, investors interest in safe haven assets like Spot Gold is swelling. The precious metal climbed above $2000 again on Tuesday and is likely to find support at that level after hitting a high of $2075 earlier this month, with analysts from Citigroup believing it could even top $2500 an ounce.

‘When investors are hungry for gold, the metal has a habit of rising exponentially which has no parallel amongst metals,’ Citigroup analyst Heath Jansen said in a note to investors.

‘On a worst-case scenario for euro sovereign debt and US fiscal problems, we believe gold could repeat the extent of the 1970-1980 gold bull market, implying upside-risk to above $2500 an ounce.’

‘A short-term (but not long lasting) large spike in gold is still possible in our view,’ he added. ‘We would now rate that probability as above 25%, up from below 5% just weeks ago (because of increased sovereign financial issues), and growing.’

Gold is trading at $1974 an ounce at the time of publication, up $231 (+13%) over the last three months alone.

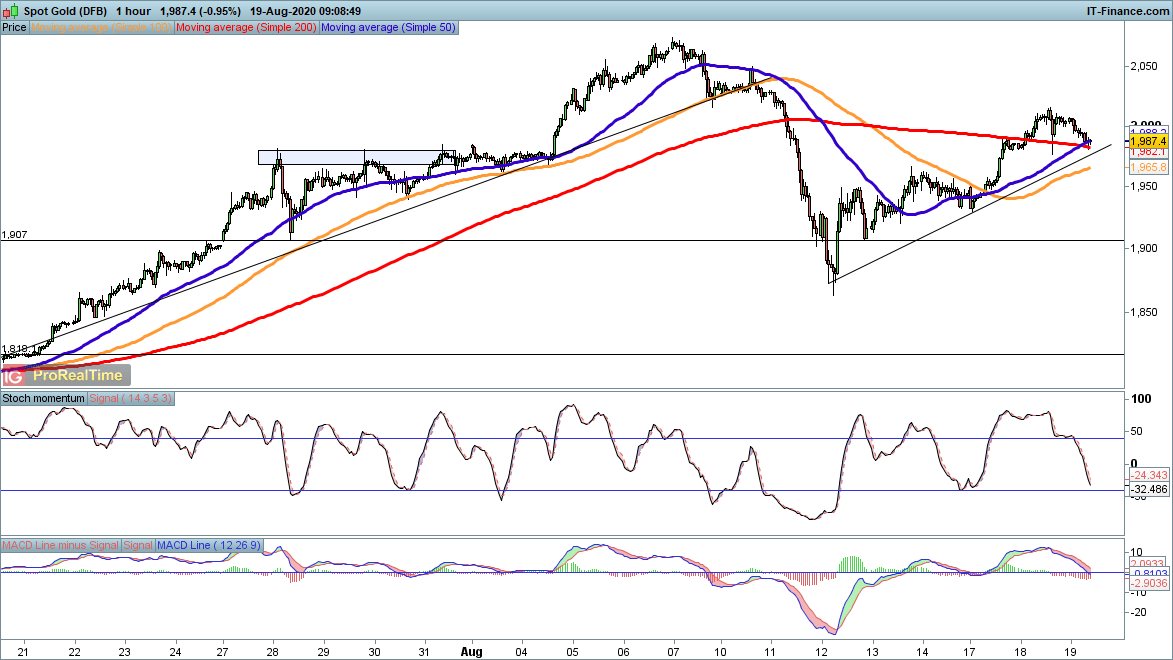

Gold: technical analysis

The price of gold continued its recovery yesterday, rallying back above $2000. It has dropped back overnight, but if it can form a higher low around $1985 then we may see the uptrend continue and the recovery make further progress, according to Chris Beauchamp, chief market analyst at IG.

‘Continued losses below $1980 call this view into question, although a more bearish view would likely require a drop below $1930,’ he added.

Sovereign debt woes could see gold hit $5000

Earlier this year, Dan Popescu, Investment Research Consultant and gold and silver analyst, spoke with IGTV’s Jeremy Naylor to discuss his forecast for gold. In the interview Popescu warned that the global economy faces a potential reset of the monetary system.

Popescu believes that in the next five years gold prices could break above $5000 due to the coronavirus pandemic and other macroeconomic factors having ‘created an explosion of government debt’.

This incredible intervention by central banks will devalue the US dollar, euro and sterling, which in turn will help drive up the price of gold in the coming years, he added.

IG.com – Aaran Fronda | Financial writer, London | Publication date : Wednesday 19 August 2020 08:10