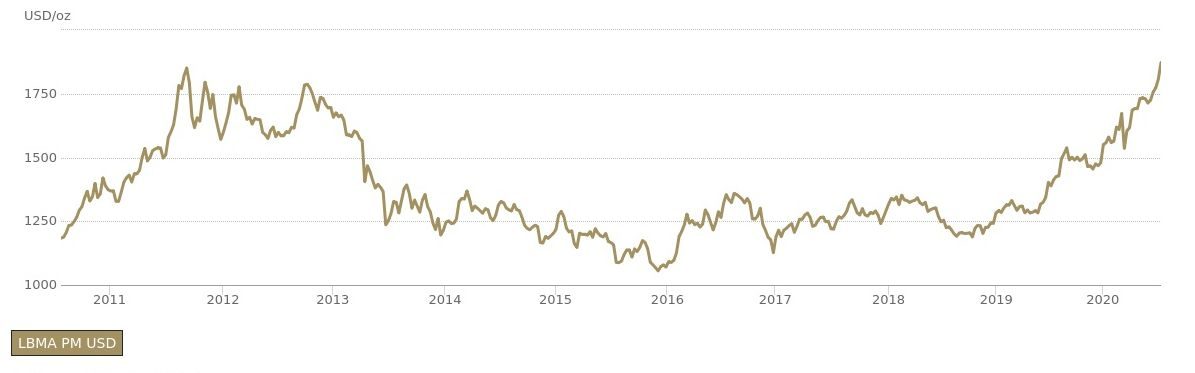

The slump in the US dollar is beginning to accelerate. The gold price leapt to a new all-time high in early trading on Monday 27 July, with silver and bitcoin also seeing strong price rises.

Gold hit a new record price of $1940 per troy ounce in Asian trading, exceeding the previous all-time high of $1922, set on 6 September 2011. Silver rose to $24.10 a troy ounce, up over 6 percent from Friday’s close, while bitcoin broke through the $10,000 mark, up over 7 percent from levels set on Friday.

Gold price

According to precious metals commentator Ross Norman, the jump in the price of hard assets shows general investor nervousness about the prospects for financial markets.

“What gold and silver are telling us is that the macro and geopolitical environments are deeply unattractive,” he told New Money Review.

“The growth in debt and the money supply are real concerns,” he went on.

The continuing fall in interest rates is also making hard assets more attractive on a relative basis, said Norman, since the opportunity cost of holding gold, silver or bitcoin is disappearing.

“Probably the single biggest driver for gold over the last few months has been the falling yield on the ten-year US Treasury bond,” said Norman.

“That has dipped below 60 basis points in nominal terms, meaning real yields are now negative.”

“Gold’s got everything going for it at the moment.”

The continuing bull market in precious metals comes as a sharp reversal of market moves seen in March, at the peak of market concerns over coronavirus.

In mid-March, a scramble for dollar liquidity caused the price of gold to fall to $1486, while bitcoin fell to under $5000 a coin.

The US dollar has since undergone a sharp reversal, however: DXY, a measure of the value of the US currency relative to the value of a basket of currencies of the country’s main trading partners, has fallen 9 percent since late March.

Earlier this month, the Bank for International Settlements (BIS) said the dollar had increased its dominance in the world’s currency markets since the outbreak of the coronavirus, while the role of the US central bank as the global lender of last resort had become further entrenched.

Some central bankers have argued that the growing dependence of the global financial system on the US is a source of instability.

Last August, Mark Carney, the outgoing governor of the Bank of England, attacked US monetary hegemony in a speech at the annual Jackson Hole symposium of central bankers, held in Wyoming’s Rocky Mountains.

“The growing asymmetry at the heart of the international monetary and financial system is putting the global economy under increasing strain,” Carney said.

Written by New Money Review Staff on July 27, 2020