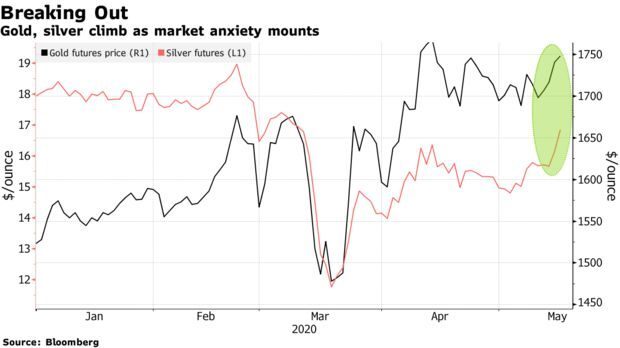

- Futures head back toward their peak in April as silver climbs

- Market anxiety is mounting, lifting safe havens: INTL FCStone

Gold jumped to a three-week high after bleak U.S. government data underscored how hard coronavirus-related shutdowns have hit the world’s largest economy.

Bullion headed back toward its peak in April, when prices hit the highest since 2012, after U.S. factory production plummeted in April by the most in records back to 1919. And a gauge of U.S. retail sales plunged through the record set just a month earlier.

“Everybody must have realized it, but it’s just more evidence that the reality is this is a pretty bleak economic picture right now,” Phil Streible, chief market strategist for Blue Line Futures LLC, said by phone. “People are continuing to pile into gold because that weak economic picture is going to continue to drive interest rates lower.”

Gold futures for June delivery traded 0.5% higher at $1,749.90 an ounce as of 9:44 a.m. on the Comex in New York, after climbing as much as 0.9%.

Silver also got a stronger bid, rallying to the highest in two months. The two precious metals have been lifted after U.S. Federal Reserve Chairman Jerome Powell warned earlier this week that the pandemic will take a heavy toll on the economy. Fears intensified on gloomy American unemployment data Thursday, and as President Donald Trump said he doesn’t want to talk to his Chinese counterpart right now.

Nations that enjoyed success quelling the virus, including South Korea and China, now face a rising number of infections. In the U.S., Texas saw its deadliest day and its biggest jump in new cases since the start of the outbreak. That comes two weeks after controversial moves to reopen the state’s economy.

“There are fears over everything from political leadership through the health outlook overall and associated economic financial and political risk,” said Rhona O’Connell, head of market analysis for EMEA and Asia at INTL FCStone. Prices are having a long-awaited breakout moment as market anxiety mounts, she said.