GOLD PRICE OUTLOOK:

- Gold prices rebounded to US$ 1,880 after hitting a six-week low of US$ 1,850 after vaccine news

- Vaccine optimism faded quickly, buoying precious metal prices. The US Dollar fell

- 89% of the retail gold traders (within IG)are net long gold, up 23% from a day ago

Gold prices tumbled 4.5% on Monday as a coronavirus vaccine developed by Pfizer and BioNTech showed a 90% success rate in an interim analysis of its phase 3 clinical trial. Optimism faded quickly however, as traders reassessed the near-term implications, with the global economy facing an imminent threat of another pandemic wave and virus-related lockdown measures. Even if the vaccine is proven successful, it may still take months before it passes all the regulatory requirements and becomes publicly available. Manufacturing capacity, storage and transportation are future challenges too.

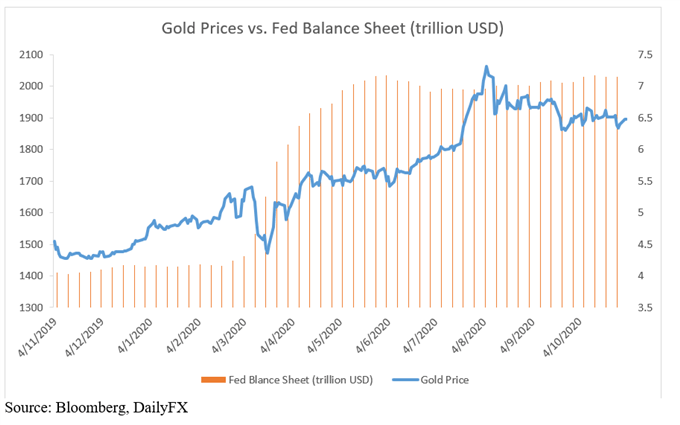

One of the main drags on gold prices is the prospect of smaller fiscal and monetary stimulus if economic growth accelerates with the help of the vaccine. The expansion of central banks’ balance sheets, alongside an ultra-low interest rate environment, have propelled a big rally in precious metal prices this year. This is because gold is commonly viewed as a good hedge against fiat money and a store of value. In the medium- to long-term, however, a slower pace of monetary easing and potential tapering may put gold at risk for a pullback.

The Federal Reserve balance sheet fell marginally to US$ 7.157 on November 4th from a record high of US$ 7.177 trillion in late October, reflecting ample liquidity in the markets (chart below).

In the near term, however, fiscal stimulus might still be needed in the US and the EU to weather through the pandemic’s impact. The monetary environment is likely to remain accommodative in the foreseeable future to prevent systemic risk and foster a fragile recovery. This might help to cushion the downside for gold prices. Uncertainties surrounding the post-election transition, pandemic, and a tepid economic outlook may also lift appetite for gold.

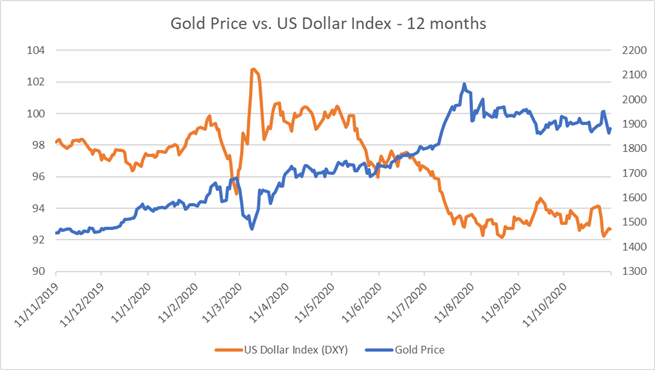

In view of a historic negative correlation between gold and the US Dollar (chart below), a weakening US Dollar may buoy gold prices. Biden’s election victory and the potential reshaping of US foreign policy appeared to have accelerated capital flows into emerging markets and risk assets, sinking the US Dollar.

Source: Bloomberg, DailyFX

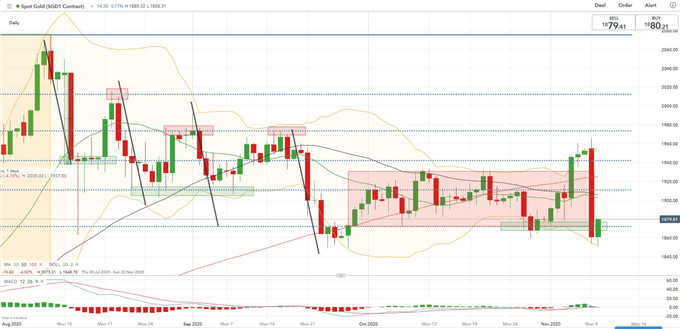

Technically, gold prices plunged 4.5% on Monday, registering their largest intraday swing seen since mid-August. The overall trend appears to lack clear direction after prices broke above the ceiling of the consolidative range (highlighted in chart below) before plunging below the lower boundary. The formation of a large bearish candlestick usually suggests strong downward momentum, which could lead to further losses with an eye on US$ 1,885 support.

Gold Price – Daily Chart

Margaret Yang, CFA, Strategist