I have found that, among the mass of simple, hardworking people who don’t know much about monetary history, there has always been a basic understanding that money based on gold and silver is a good idea. It is one of those basic good ideas that people don’t question much, along with: work hard, value family, don’t tell lies, and so forth. They have a basic skepticism of the class of elitist money manipulators (central bankers and academics) who make all sorts of complicated arguments that they should engage in an ever-more-aggressive program of monetary and credit distortion, for your own good.

There have always been people who attempted to manipulate the money. The philosopher Plato, in The Laws, recommended a local government-controlled fiat currency (likely made of iron), and the abolition of the gold and silver coinage then in common use in Greece. When he wrote it, Plato had just left Sicily, where he advised the local tyrant. This tyrant attempted several times to debase the local coinage, possibly according to Plato’s advice, making him very unpopular. It didn’t work out very well for Plato: he was thrown in prison, and, according to some accounts, was sold at a slave market in Corinth where, by lucky chance, some friends happened to come by and purchase his freedom.

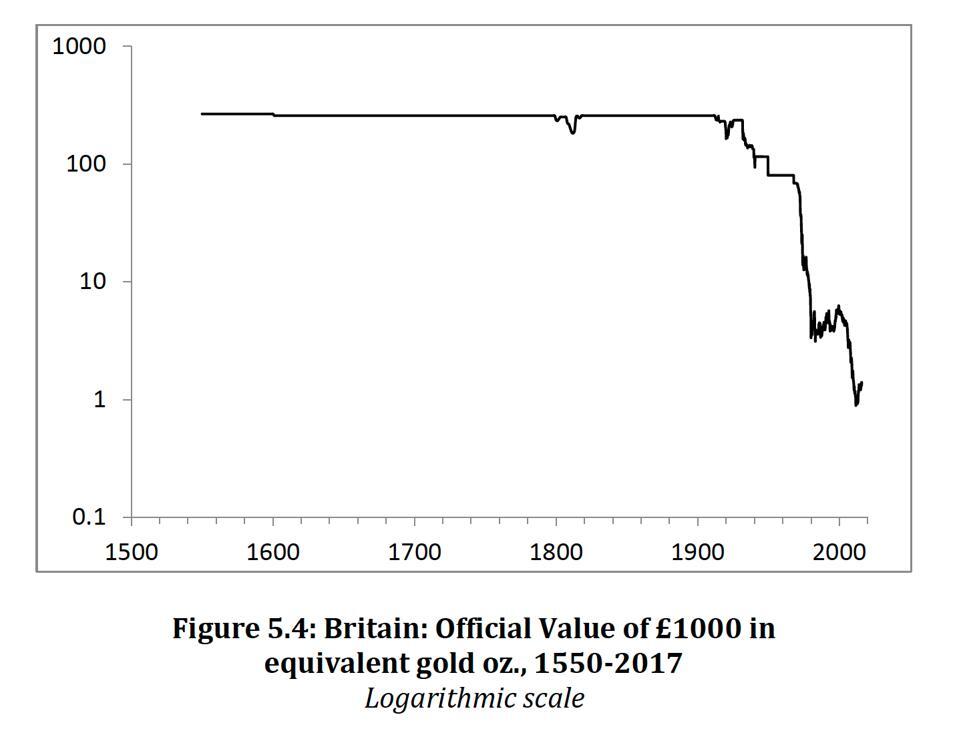

Value of the British Pound in gold, 1550-2017. (gold/silver parity of 1717 used prior to 1717).

NATHAN LEWIS

So much for monetary rule by “philosopher-kings.” Plato’s student Aristotle, perhaps learning from these misadventures, became a hard-money man, and advised his student Alexander the Great. Greece stuck with unchanging silver coinage for another four centuries, which became the premier international currency in the Mediterranean region.

I reviewed the history of gold and silver money in my book Gold: The Final Standard (2017). Actually, the use of gold and silver, in a monetary role, goes way before Plato. It goes back even before the invention of writing, in Sumer around 3300 BC. Although shell rings and wheat served as early Sumerian currency from about 3500 BC, by 2700 BC, silver had become the primary monetary standard of Sumer, with gold alongside in a supporting role. In neighboring Egypt, the primary producer of gold in the Ancient period, gold was the preferred high-value money. As early as 2700 BC, Egypt produced a standardized “ring” money of gold, stamped with an indication of weight. Already by the time of Plato, gold and silver had been the primary high-level form of money for over two thousand years.

The history of money since that time is basically one long tale of gold and silver, leading up to the Classical Gold Standard of the pre-1914 era, and then the Bretton Woods gold standard beginning in 1944, and ending in 1971. This is true in the West, but it is also true in the East. Gold and silver coinage was the norm in India from the sixth century BC. Gold was the primary high-value money of the Han Dynasty (202 BC-220 AD) in China.

“But,” today’s economists might claim today, “people in those days were simple and stupid, but we are oh so very smart. They simply didn’t have the options we have today.” Clay tablets recording a deposit of silver at a central bank date from the second millennium BC in Sumer. They traded among third parties — an early “paper” currency. Paper was invented in China in 105 AD. The first Chinese paper currency dates from 140 AD. When Marco Polo returned to Europe from China in 1295, he brought with him knowledge of gunpowder, the burning of coal, paper, the printing press, and paper money, which had been in common use in China for nearly 500 years by then.

Along the way, Polo stopped off in Persia, to drop off a Mongol princess. In 1294, the King of Persia introduced the first unredeemable paper currency in the West, in the city of Tabriz. It didn’t go well.

Looking back on centuries of paper money experiments in China, the fourteenth-century historian Ma Twan-Lin concluded:

Paper should never be money (but) only employed as a representative sign of of value existing in metals or produce … At first this was the mode in which paper currency was actually used among merchants. The government, borrowing this invention from private individuals, wished to a make a real money of paper, and thus the original contrivance was perverted.

This is exactly what happened in the American Colonies, which, for a century, were among the biggest paper money abusers in the Western World. The first government paper currency was issued by the Colony of Massachusetts in 1690; the Continental Dollar died in hyperinflation in 1781. This experience drove the Founders to include a mandate to use gold and silver coinage, in Article I Section 10 of the Constitution of 1789. The U.S dollar maintained a nearly-unchanged value of 23.22 grains of gold ($20.67/oz.) from 1792 to 1933, with a major lapse during the Civil War. After a devaluation in 1933, the dollar was linked to gold at $35/oz. until 1971.

Through all this time, a simple pattern emerged: those countries that stuck to gold and silver, and unchanging coinage, tended to be successful. Stable Money works. Those that experimented with devaluing their currencies (debasing coins), or fiat paper currencies, ran into problems. The Chinese often had several decades where their paper fiat currencies worked well, or when the trend of decline was modest enough that people could get by. But, they all ended in disaster.

In the late 19th century, a final decision had to be made between gold and silver. People chose gold; and silver, which had for thousands of years traded in a stable ratio with gold, lost its monetary quality and became volatile. Gold is the only option remaining today.

From all this, we can come to some simple conclusions: gold works. Without entering into any very detailed study of history, we can see that gold has come out on top again and again, in both the West and the East. It has worked well enough that there has never been a good reason to replace it with something else. The history of coinage, over more than two thousand years, is largely a history of coinage debasement. But, those governments that maintained an unchanging value for their coins came out on top. This was true of the Byzantine Empire, whose gold solidus coin contained an unchanging amount of gold for over 700 years. It was true of the Netherlands in the seventeenth century, whose global empire expanded while Spain debased its coinage into oblivion. It was true of Britain in the eighteenth and nineteenth century, whose British pound maintained an unchanged parity with gold at 3 pounds 17 shillings 10 pence for over 200 years. It was true of the United States, which, between 1914 and 1971, had the most reliable gold-based currency in the world.

The last decade of the global gold standard system, the 1960s, is still regarded as the best decade for global economic prosperity since the end of the Classical Gold Standard era in 1914.

This brings us to today. “It’s a yellow rock!” scream legions of PhD-bearing central banker wannabees. True —and that yellow rock has been wiping the floor with the likes of you since the beginnings of recorded history. Actually, the funny-money people destroy themselves, while gold just sits quietly inert. We say of things that are stable, solid and reliable, that they are “like a rock.” This is a good thing. This is what we want money to be, and gold is the best approximation of this ideal that we have — and approximation that, while never perfect, has always been Good Enough.

For now, we are in our Debt Jubilee period. But later, when this is completed, sensible people will look back, and see that today’s Philosopher-Kings have failed in exactly the same way they have always failed. We will want something that works: and there is only one thing that has always worked.

Forbes.com – Nathan Lewis – Contributor