JPMorgan has earned record revenue of around $1 billion so far this year from trading, storing and financing precious metals (gold), vastly outperforming rival banks, two sources familiar with the matter told Reuters.

The coronavirus has created a bonanza for investment banks dealing in gold, silver and other precious metals by triggering massive investor purchases and rupturing the normal workings of the market.

But JPMorgan has dominated, growing its share of the market.

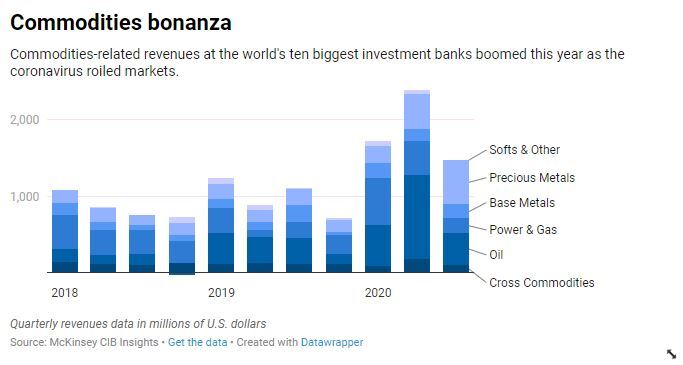

The U.S. bank’s revenue by mid-November accounts for at least half of the $1.7 billion to $2 billion that consultancy McKinsey CIB Insights estimates the top 10 investment banks combined will make this year from precious metals, mostly gold.

Its commodities division is on track to bring in more than $1.5 billion this year and could challenge Goldman Sachs for the title of top earner, the sources said.

JPMorgan and Goldman Sachs declined to comment.

Individual investment banks have rarely made more than $1 billion in commodities in recent years, and none has ever before earned more than around $600 million in precious metals in a single year, said George Kuznetsov at McKinsey CIB Insights.

JPMorgan is the largest bank in the United States and one of the biggest in the world.

It sits at the heart of the global bullion market, and its activities span trading physical bars to derivatives, running vaults and clearing trades in London, the biggest trade hub.

REVENUE WINDFALL

Driving profit has been the clamour for gold and silver from investors, mainly in Europe and North America, worried the coronavirus pandemic and money-printing by central banks could devalue other assets.

These investors pushed gold prices to record highs above $2,000 an ounce earlier this year.

Added to that are profits earned on the Comex futures exchange in New York, where supply issues earlier this year made it more lucrative for those with access to physical gold to trade precious metals.

Banks such as JPMorgan took advantage of opportunities on Comex and helped clients do the same.

JPMorgan’s client business dwarfs that of others.

Data from CME Group, which runs Comex, show JPMorgan’s clients accounted for one-third of all trade in gold bars registered with the exchange in October, and more than two fifths in June.

Like other big banks, JPMorgan was able to get and ship metal cheaply and in large quantities when other, smaller traders could not, sources said.

The revenue windfall will likely fade as trading on Comex reverts to normal patterns, but high gold prices and interest from investors mean this business will remain profitable.

“2020 is going to be an outlier year,” said Kuznetsov at McKinsey.

Reporting by Peter Hobson; editing by Pratima Desai and David Evans