A new year – thankfully – quickly approaches, which means an avalanche of market predictions is soon to cascade across Wall Street. So, let’s jump the line and get ahead of the crowd: 2021 could well be the Year of Gold.

Not that 2020 hasn’t already been a solid year for the anti-dollar. Gold trends, at a recent $1,910 per ounce, is up 25% for the year, and there’s still the potential for an election disaster or a non-peaceful transfer of power that could propel the metal even higher on the “fear trade.”

But let’s assume that’s not the case and gold has a fairly uneventful final two months of the year. That brings forth 2021 and either a new administration in the White House, or the same administration. And either administration will very likely mean higher gold prices as the approaching year unfolds.

Both presidential candidates have been making economic promises that are conducive to gold price strength. As those promises are fulfilled – and they likely will be in some fashion – gold will very likely surpass the record high of $2,067 it set in August.

On one side of the ticket, Mr. Trump is promising the “biggest tax cut ever” that, theoretically, would benefit middle-class taxpayers who lost out in his previous tax cut. On the other side, Mr. Biden is promising a substantial stimulus package and certain economic policies – a $10,000 minimum student-loan forgiveness – to help the vast swath of Americans who are out of work and struggling to stay afloat financially.

Either one of those platforms would cost trillions of dollars. And, alas, Treasury hasn’t a single one of those dollars in its wallet to cover the expense So, as is normal in America, Uncle Sam will go with hat in hand to the bond market and beg for another lifeline from investors. The dirty little secret, of course, is that Uncle Sam is effectively bankrupt and investors aren’t likely to ever recoup a meaningful, real return on the money they invest in US debt.

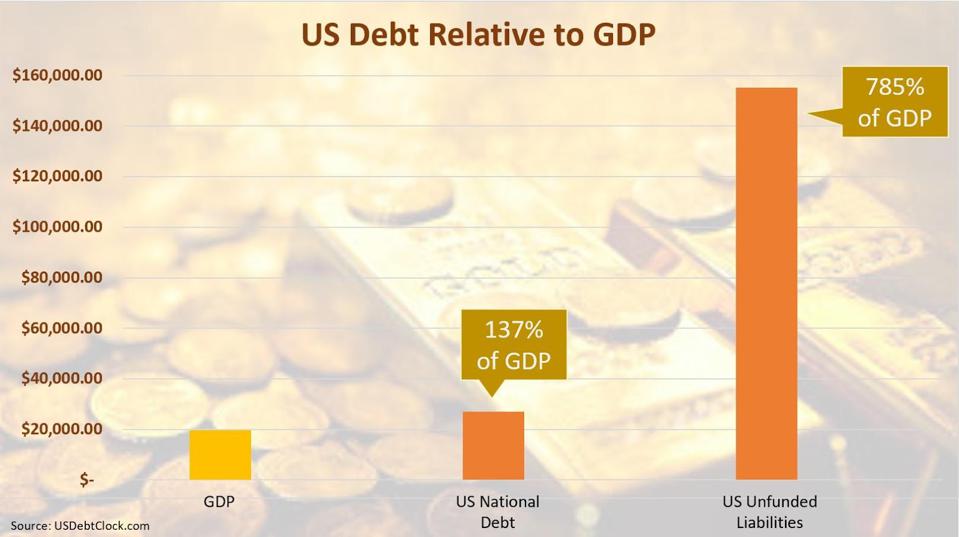

Debt in America exceeds $27 trillion now, or 137% of the economy. As troubling as that number is, it radically undercounts the true depth of America’s debt-fueled woes. Obligations for which the US is already on the hook – entitlement programs, federal employee and veteran benefits, etc. – means the country really owes more than $155 trillion, or nearly 800% of GDP.

US Debt Relative to GDP

USDEBTCLOCK.COM

Certainly, Congress will find a way to sharply reduce those obligations at some point in the future, to the detriment of beneficiaries. In the meantime, however, Uncle Sam will rely on his buddies inside Treasury to do his bidding by keeping interest rates near 0% while stoking inflation by printing oodles of dollars.

There really is no other way. America’s already-large economy can’t expand nearly fast enough to pay down the debt, particularly when the US must issue more and more debt just to keep the lights on and to pay interest on existing debt. And an outright default on some of the debt, while certainly not impossible, seems unlikely, given America’s need to maintain the “full faith and credit” pledge backing its bonds.

The only viable solution is to let the dollar drift lower – or for the government to reprice gold relative to the dollar, as FDR did in 1933. Maybe that happens at some point in the future; maybe it doesn’t. But an ever-weakening greenback seems baked into the cake at this point. Yes, the buck will have its moments of strength and vigor, but the coming year looks like another strong one for gold nonetheless. As the dollar losses, gold wins.

Very likely, gold tests the $2,500 level in 2021, a 30% gain from current levels. The metal could even test $2,700, depending on the global market’s reaction to a declining dollar.

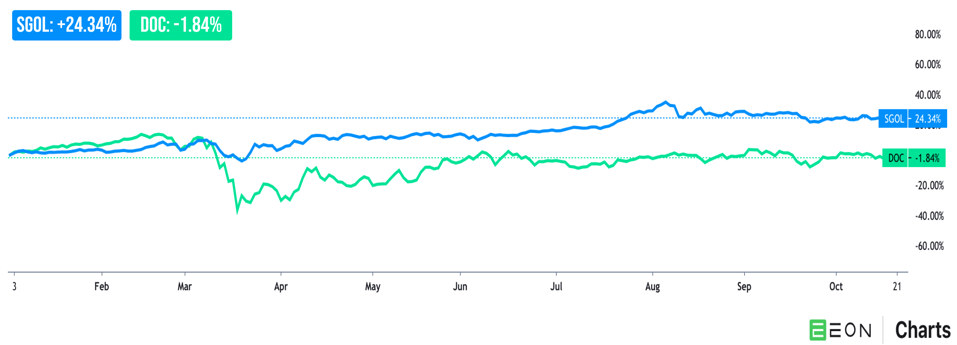

Physical gold is always the best way to play this, if only to protect yourself in the event of a monetary crisis. If, however, you want to a more convenient form of gold for an investment account or a retirement account, take a look at Aberdeen Standard Physical Gold Shares ETF (SGOL) SGOL +0.1% or Sprott Physical Bullion Trust (PHYS).

YTD performance for Aberdeen Standard Physical Gold Shares ETF and Sprott Physical Bullion Trust

EEON INC

Both are a better take on exchange-traded gold than are certain other, larger gold ETFs since both Aberdeen Standard Physical Gold Shares ETF and Sprott Physical Bullion Trust own allocated bars and are not subject to the same counter-party risks. In a crisis, those counter-party risks could haunt unsuspecting investors who think their paper gold is the same as physical gold.

Given the excessive and growing level of US debt, and given the spending promises from both presidential candidates, gold is set up for a robust 2021. It’s not too late to buy.