The US dollar is a relatively stable currency with significant value on the global market. The idea of the dollar collapsing might seem unthinkable — but it’s happened in the past. With the national debt reaching more than $30 trillion in 2023, many investors are searching for investments to protect themselves.

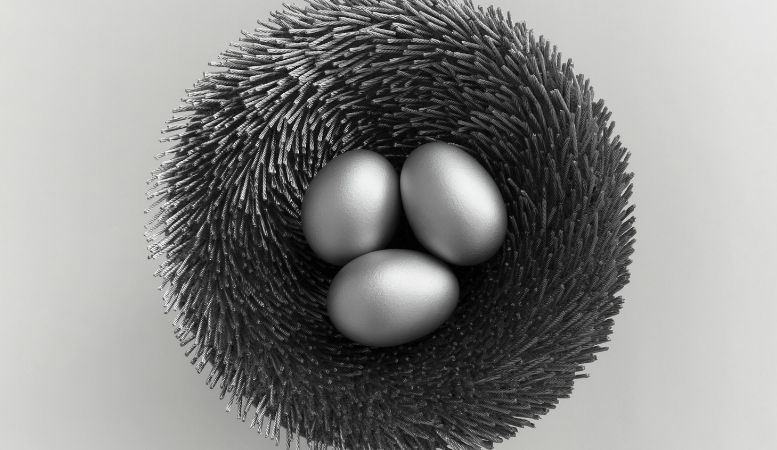

Silver, in particular, is an attractive option — but how much will silver be worth if the dollar collapses? Is it a worthwhile investment, or should you consider purchasing different assets? Discover more about silver’s performance in past economic downturns, its current value, and how to protect your investment with Oxford Gold Group.

Silver’s Value in a Potential US Dollar Collapse

The US dollar may seem relatively stable, but relying solely on a single currency for your investments can seem a bit risky. If anything happens to the dollar’s value, then you might find yourself facing unexpected financial hardship.

That’s why many investors consider investing in precious metals. Unlike the dollar — which the government can print on demand — precious metals are a finite resource. Limited availability means the value of precious metals tends to increase over time, especially as demand rises.

Silver, in particular, is an appealing option to investors. The price of silver isn’t directly linked to the dollar, which means that its value can rise or fall independently. As such, it can potentially maintain its overall value, even if the dollar itself experiences a crash. Silver is a stable investment because many industries use it in manufacturing, so demand is relatively consistent.

Silver’s Performance During Past Dollar Crises

How much will silver be worth if the dollar collapses? The answers have varied over the years; in most past economic downturns, the price of silver has decreased slightly. There were, however, two exceptions:

- In 1978, the United States faced an economic crisis. However, while the dollar’s value decreased, silver’s value didn’t. Instead, the price of silver rose by about 15%.

- In 2009, silver remained relatively stable, even though the overall economy saw a decline.

Because of these two instances, there’s evidence that silver’s value can increase, even if the overall market faces difficulties. By investing in silver bullion or silver bars, you can potentially protect yourself from economic problems (like a stock market crash) with a diversified portfolio.

The Silver Advantage in Dollar Collapse

Silver is a traditionally undervalued metal. Silver often seems inferior to gold or platinum, and so many investors may decide to purchase different precious metals instead of silver.

However, silver has an advantage that many other precious metals don’t: its use in manufacturing. Countless industries — including automotive manufacturers, dentists, solar companies, and more — use silver in their products. Because of this, silver is in constant demand — and, moreover, it’s a finite resource that’s becoming more scarce. This high demand and decreasing supply can cause the overall value to rise over time.

But that isn’t the only advantage silver offers. You can use silver as a currency in many places around the world — which means that if the dollar ever collapses, you could use your silver to pay for food, commodities, and more.

Is Silver a Good Investment?

Most experts agree that silver is a solid investment overall. Its use in manufacturing — combined with the ability to use it as currency — means that it’s a safe investment overall with few drawbacks. However, it’s still important to take several factors into account to determine if it’s a good investment for you.

Silver’s Price in Today’s Market

The price of silver is often around $0.65 per gram or $653 for one kilogram of silver bullion. That said, prices can fluctuate due to the following factors:

- Supply and demand: The amount of silver available is limited — and, more importantly, it is constantly in demand due to its use in manufacturing. Limited supply and high demand mean that the prices of silver could rise in the future, so it’s important to keep an eye on the market for any price fluctuations.

- Inflation: People traditionally think of paper money when they hear inflation. However, inflation can affect precious metals, too. Rising inflation often means rising silver prices, so stay tapped into the market to determine how the value might change.

- Governmental policies: The United States controls a significant amount of the world’s silver supply. Because of this, any policy changes (or governmental changes in general) may affect silver’s overall value.

- Worldwide demand: While the United States government may control a significant amount of the world’s silver, it doesn’t have all of it. Investors should pay attention to demand on both a worldwide and local scale to determine how silver prices may fluctuate.

The Uses of Silver in the Marketplace

Many industries utilize silver in their production processes. Dentists use silver to create fillings, and computer manufacturers use silver to create chips for their products. Silver is also in batteries, solar panels, glass coatings, and much, much more. Because of its constant demand, investing in silver may help protect you against market instability.

If you would like to invest in silver, you could purchase any of the following:

- Silver bullion bars: If you want to physically own your investment, then purchasing silver bullion may be your best bet. You can purchase silver bullion in various quantities, though 2, 3, and 5 oz. bars are common. Oxford Gold Group offers a range of silver products to choose from, including coins and bars. We would be happy to help you explore your options to find something that suits your needs.

- Silver IRA: An individual retirement account (IRA) provides individuals with tax-deferred savings to support their lifestyles after they retire. For most standard IRAs, this means purchasing stocks. Silver IRAs work similarly; they simply replace stocks with silver. Oxford Gold Group offers silver IRAs that can help you secure your retirement and move into the future with confidence.

- ETFs: Exchange-traded funds (ETFs) offer a unique investment opportunity if you want to invest in silver without owning physical bars. Essentially, you purchase a share in a commodity rather than the commodity itself. You’ll track the value of the commodity, but you won’t own it yourself.

- Stocks: Stocks are common investment options; many investors have at least dabbled in the stock market. If you want to invest in silver stock, then you can purchase stock in silver mining companies or stock in operations that fund those companies. That said, you’ll want to keep an eye on the stock market to make sure that you’re making the most of your investment and balancing your portfolio with non-stock investments.

Will the US Dollar Collapse Again?

When the national debt rises, many investors may worry about the dollar’s stability. Thankfully, however, the US dollar is still relatively stable.

Generally speaking, a collapse could happen for one of the following reasons:

- Hidden weaknesses: Not all currencies are stable; some may contain hidden weaknesses that can cause them to crash unexpectedly. That said, the US dollar doesn’t currently have any of these weaknesses. In fact, its overall worth increased by 30% between 2008 and 2020. The pandemic caused that value to rise by an additional 10%. Because of this value increase, a drastic drop is unlikely.

- Alternative currencies: The US dollar holds a unique place in the global market. It makes up over 60% of the world’s reserve currency, which has helped it to remain relatively stable over the years. Few alternative currencies can compete with it; the euro is the closest, and that only makes up 20% of the world’s reserve currency. Since few currencies can compete with the dollar, its purchasing power is likely to remain stable in the future.

Without any alternative currency options or potential vulnerabilities, the US dollar likely won’t experience a decline in value despite the high national debt.

Preparing Your Portfolio for a Dollar Collapse

While the dollar is unlikely to collapse, you still want to diversify your portfolio to protect yourself. Think carefully about the following factors to keep your investment safe:

- Consider your risk tolerance. How comfortable are you with making large investments? If that risk didn’t pay off, how much trouble would you be in? It’s important to stop and consider your goals, your comfort levels, and the state of the market to determine how to proceed.

- Consider rebalancing your portfolio. Rebalancing can be an incredibly helpful tool for investors. Essentially, rebalancing your portfolio involves buying or selling assets to maintain a value you’re comfortable with. Consider working with a professional to determine a solid value for your portfolio and how to maintain it.

- Don’t act rashly. When silver prices fall, investors may panic. Many people may consider selling their assets immediately to try and protect themselves. However, it’s important not to make any rash decisions; precious metals are long-term investments, and their prices may easily go up again. Take a step back and assess the situation; determine if the current state of the market merits selling your assets, and then take action accordingly.

Silver can be an excellent addition to your portfolio; its relative stability, high demand, and use as an active currency can be incredible boons, helping you to hedge against market instability, even if the US dollar were to crash.

How much will silver be worth if the dollar collapses? The exact price may fluctuate, but because of its use in manufacturing, it’s likely to remain stable, even in economic hardship. By adding it to your portfolio, you can worry less about the changing market.

Now may be one of the best times to purchase silver. At Oxford Gold Group, we offer silver IRAs, as well as various silver products for purchase. Call 833-600-GOLD to learn more about our products.